Post client discovery meeting, comprehensive Planning is the next step when we start working with you. This often includes compiling and presenting large amount of data, in order to gain clear understanding of the current state of your wealth. Thorough understanding of your financial objectives help us to map and execute the overall research- backed Wealth Management Strategy. It often includes some or all of the following:

Wealth First works with you and your advisors in specific disciplines. We identify priority issues, map out a game plan and develop solutions together with you to meet the family’s objectives. Our hands-on experience in all key financial disciplines uniquely positions us to put-up all the pieces of the puzzle together.

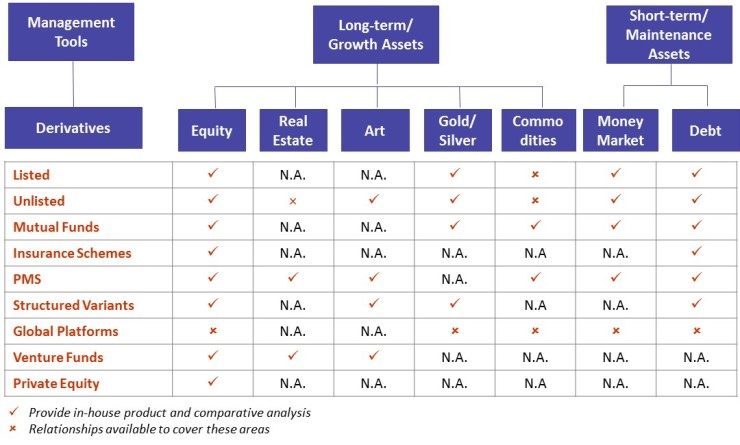

We have various offerings across asset classes made to suit investment needs of each family. In all these asset classes our endeavor is to actively manage your portfolio, making research backed investment decisions:

Apart from supporting all business activities, optimization of the overall cost of funding is the ultimate objective of any corporate treasury.

It involves spending less on borrowings, earning more on investments, and managing the realization of flows.

With extensive experience in handling such activities, we would be able to provide comprehensive treasury solutions to corporate treasuries.

These services vary on the unique needs of the family, and could include following:

Wealth First could also assist a family identify an expert in areas relating to

By remaining engaged with you and your advisors, we can proactively address your evolving needs and recommend new ideas to add value

Below are major category investment solutions offered by Wealth First