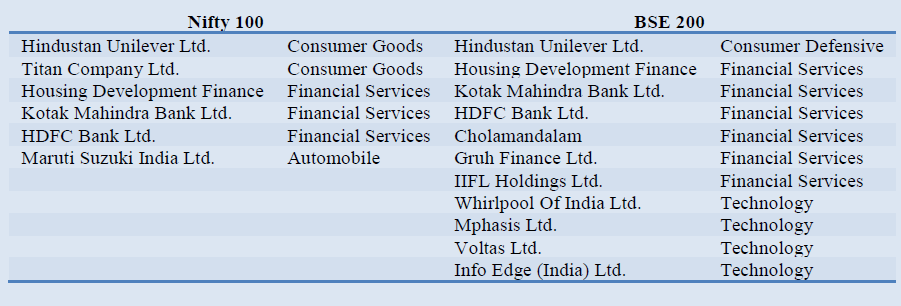

Steering your investments through equity markets at current market scenario in the backdrop of spiked volatility, stretched valuations and pre-election uncertainty, exposes your portfolio to higher risks. Trying to time the market at this juncture might set up more adverse bets. Since September 2017, we have experienced market peak towards January end and subsequent corrections of over 10% by March end. Encasing this market movement, we filtered scrips from Nifty 100 & BSE 200 Indices which outperformed market in both the scenarios. The filtered scrips were further validated across last 2 years performance vis-à-vis Indices. To encase the pre-election uncertainty, we filtered sectors which outperformed the Indices in past pre-election period i.e. 1 year prior to the outcomes of elections. We have identified 6 scrips in the Nifty 100 Index and 11 scrips in the BSE 200 Index which might outperform the Indices for the period of 1 year from now. The following table highlights the Scrips.

To view the detailed report kindly click the below link: