After considerable period, financial markets are providing a very good opportunity to lock into attractive post tax returns with almost zero risk.

As inflation caught up over last six months, RBI hiked official rates and as a result interest rates on long term governments bonds moved up from 6 to 7.5% per annum. Government bonds are considered as zero risk as it comes with sovereign guarantee.

Seizing this opportunity of higher interest rates, market is providing an opportunity in the form of “Target Maturity Funds” which are targeted to provide attractive rates for long term investors.

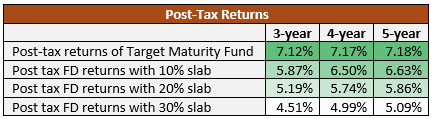

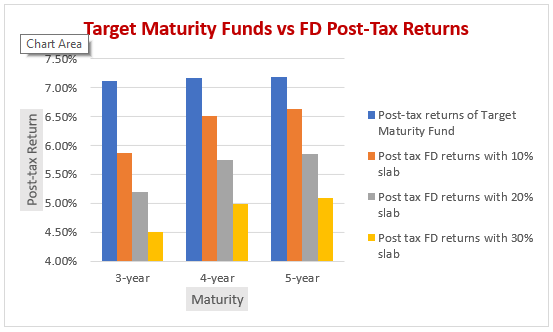

Current tax provision (long term capital gain) makes it more interesting as entire income after three years almost becomes tax free due to indexation, assuming 7% inflation. Thus, there is considerable benefit of up to 2% per annum compared to bank fixed deposit.

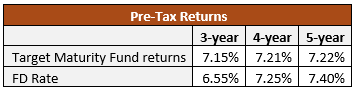

The table below shows how target maturity funds compare with conventional FDs.

Only caveat is unlike fixed deposit, this investment in target maturity funds should be for a minimum period of 3 years without any withdrawals.

On the risk front, these funds are much safer as investments are into govt. bonds. Liquidity is available but one loses the tax benefit if withdrawal is before three years.

By investing in target funds of various maturities, one can get benefit of participating in higher rates after the first investment matures which is called laddering.

If one is looking at higher post tax returns with no hassles of TDS, these funds provide good opportunity for investment.