The U.S. jobs report provides key insights into employment, wage growth, and economic trends, heavily influencing the Federal Reserve’s (Fed) rate decisions. Historically, the Fed has been more reactive than proactive in adjusting rates.

In the current tightening cycle, a weak jobs report could prompt rate cuts, affecting currency (USD/JPY) and stock markets globally, including Nifty and Sensex in India.

US Jobs Report and Fed Rate Decisions

- Strong jobs data signals a healthy economy, leading the Fed to raise rates to control inflation.

- Weak data indicates a slowdown, prompting rate cuts to stimulate growth. The Fed has aggressively cut rates only during major crises like 2008 and COVID-19.

Current Rate Hike Cycle and Market Impact

- A weak July 2024 jobs report may force the Fed to cut rates sooner to prevent recession.

- Historically, post-tightening rate cuts boost markets, but delayed cuts can trigger volatility before recovery.

- Rate cuts support equity markets but may trigger carry trade unwinding, driving safe haven flows into the yen and increasing global market volatility, including in India (Nifty/Sensex).

Dollar-Yen (USD/JPY) and the Carry Trade as Signals

- USD/JPY reflects U.S.-Japan interest rate differentials. Fed rate cuts weaken the dollar, strengthening the yen.

- Carry Trade: Fed cuts reduce yield differentials, leading to a weaker dollar and rising yen.

- A weak jobs report could drive safe haven flows into the yen, signalling global economic concerns.

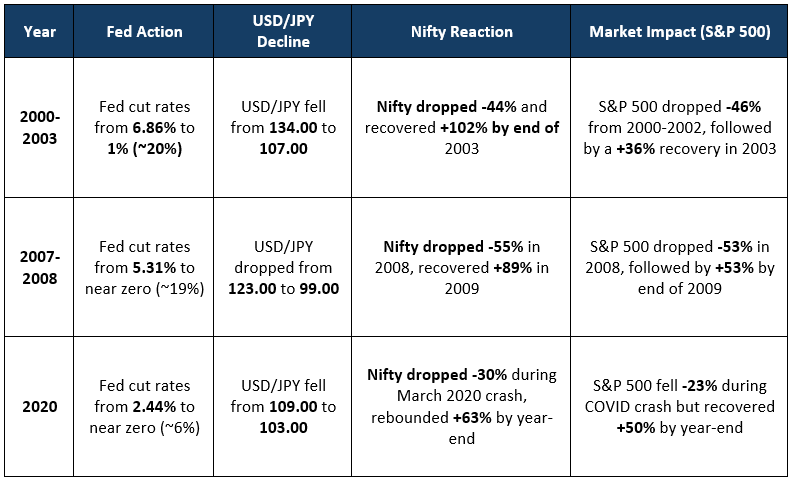

Quantified Historical Instances:

In all these instances, Equity markets (both Global and domestic) as shown in the table above have corrected significantly to the tune of over 20% before the big rally.

Conclusion

With a rate cut expected in September (with many of them expecting a 50-bps trim) and USD/JPY already down 11% since July, the U.S. jobs data on 6th Sep will be crucial. Many see the Fed’s response as delayed, possibly leading to market volatility or correction before a major rally.

Subscribe on LinkedIn