As Election Day on November 5, 2024, draws near, the fierce competition between Donald Trump and Kamala Harris intensifies, particularly in key swing states. This election is pivotal, as its outcome will significantly influence the future of markets, shaping economic policies and investor confidence.

Market Trends

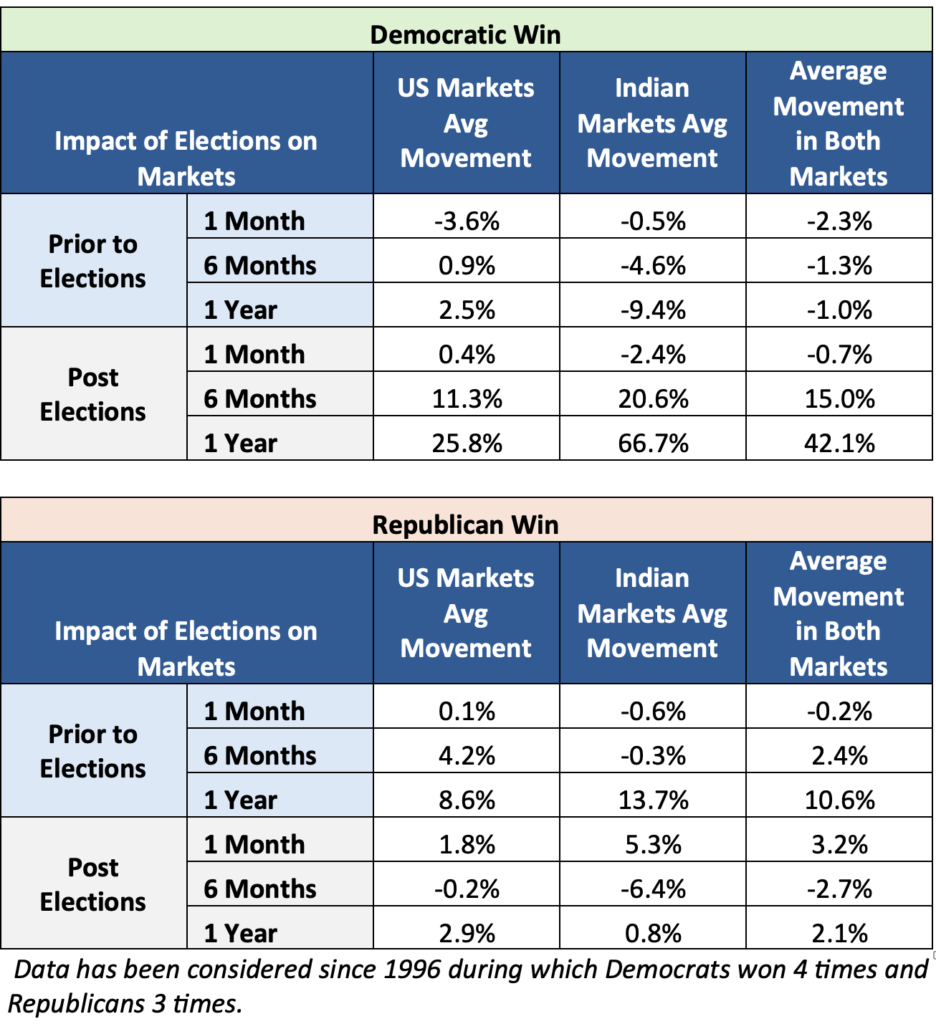

- Leading up to elections, US markets typically see a -2% return on average, while Indian markets average -0.5%.

- Post-election rebounds are notable, particularly after Democratic victories, with US markets averaging 25.8% and Indian markets 66.7% over a year.

- Republican wins result in more modest gains of 3% and 0.8% respectively.

The tech sector, including NASDAQ and Nifty IT, consistently show growth post-elections, regardless of the winning party. This underscores its critical role in market dynamics.

Market Outlook

Prediction markets currently favor a Trump victory, suggesting potential volatility, especially in bonds and oil prices. Historically, US markets rise over presidential terms, with political gridlock often seen as favourable due to limited policy changes.

Conclusion

While the immediate impact of the elections remains uncertain, historical data indicates that Democratic wins traditionally boost market confidence, particularly benefiting the tech sector. Either way, post-1yr-election results have been positive with only variations in the degree, irrespective of the winning party.

However, geopolitical shifts under either candidate could affect global stability and market dynamics. Investors should prepare for varied outcomes, maintaining flexibility as events unfold.

Subscribe on LinkedIn