As geopolitical tensions in the Middle East escalate, global oil markets are once again on edge. Following recent strikes by the US on Iran’s nuclear facilities, the Iranian Parliament has reportedly approved the closure of the Strait of Hormuz, a critical chokepoint that handles nearly 30% of global oil and a third of the world’s LNG trade. This raises the possibility of a sharp spike in crude oil prices.

Impact on India’s Oil Imports:

- India is the third-largest crude importer globally, with an 85% dependency on imports, and the fourth-largest gas buyer.

- Under normal circumstances, this would be concerning – but India’s strategic diversification of oil sources has provided a cushion.

- India currently imports a significant share of its oil from Russia, currently its largest crude supplier, with logistical routes detached from the Strait of Hormuz.

- Additional sourcing from the US, Brazil, West Africa, and Latin America adds further resilience.

- India’s energy security remains stable, with ample reserves and multiple supply routes in place.

How Does Nifty React when Crude Rises?

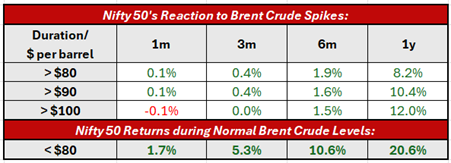

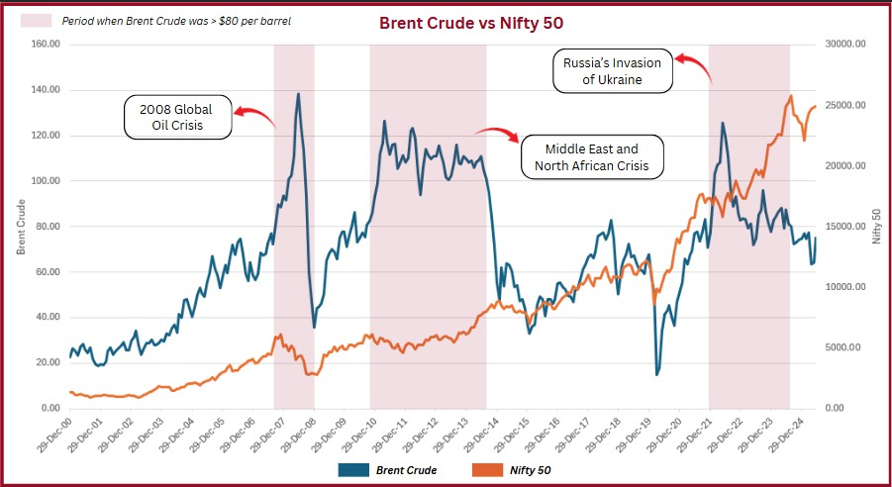

Table: Nifty 50’s 1m, 3m, 6m, 1y rolling period returns during the past 25 years.

- Contrary to popular belief, high crude prices haven’t always led to market declines.

- Though returns tend to be significantly lower compared to times of stable crude, Nifty has consistently demonstrated resilience amid elevated oil prices. It has still delivered long-term gains even when Brent crossed $100/barrel.

What Can We Expect Now?

If the Strait of Hormuz is blocked, Brent crude may spike in the short term ($75.86 per barrel as of 23rd June, 2025). However, considering:

- India’s robust and diversified energy sourcing

- Nifty’s historical resilience during oil price shocks

Initial market volatility is possible, but a sustained downturn is unlikely– especially if crude prices remain below the extreme 2022 levels (>$100/barrel).

Conclusion

While event risk from geopolitics is high, India’s diversified energy strategy and Nifty’s track record through past oil shocks suggest that investors should stay calm and focus on long-term fundamentals, and not the short-term geopolitical noise.

Please note that the above should not be construed as an advice from us. Our company is in the business of distribution of suitable Financial Products to investors describing product specifications, material facts and the associated risk factors. We are acting as a Distributor for these products and facilitating transactions.

Subscribe on LinkedIn