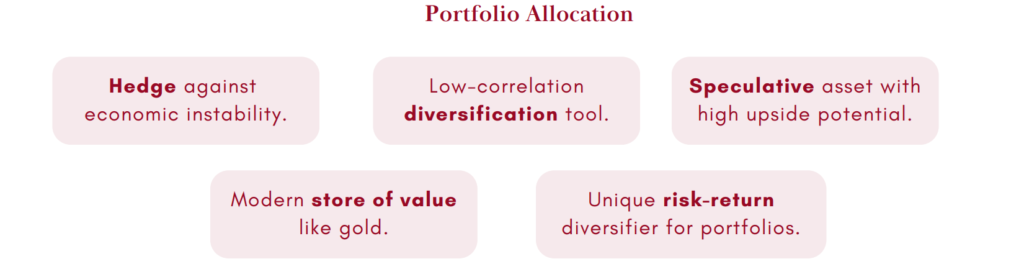

Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) are gaining global recognition as stores of

value and diversification tools. Bitcoin, with its fixed supply of 21 million coins, is seen as “digital

gold” and a hedge against inflation and fiat currency depreciation. It has given 1.7 million%+

returns since inception. Ethereum powers smart contracts and supports decentralized applications

in DeFi, NFTs, and beyond.

Investing in Crypto via ETFs

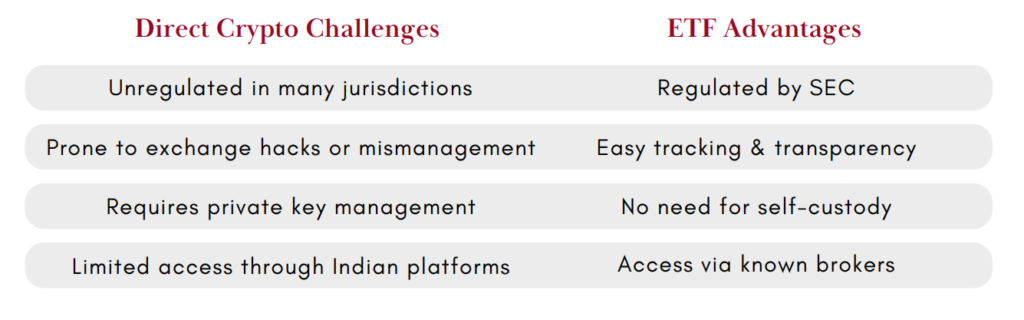

Direct crypto purchases require holding assets in personal wallets, exposing investors to custody

and security risks. In contrast, U.S.-listed Crypto ETFs offer a safer, regulated exposure as they are

SEC-registered and trade on major exchanges like NYSE, CBOE, and NASDAQ

How are Crypto Assets Owned by ETFS?

Custody model: Spot ETFs hold actual crypto in cold storage (which means it’s kept offline,

disconnected from the internet) via regulated custodians (e.g., Coinbase Custody, Galaxy

Digital)

Investor side: You own ETF shares, not the crypto itself – comparable to owning gold ETF

shares, rather than physical bullion. That means no private key control or wallet access.

How to Invest?

Indian investors must follow the Liberalized Remittance Scheme ($ 250,000/year) for transferring

USD abroad.

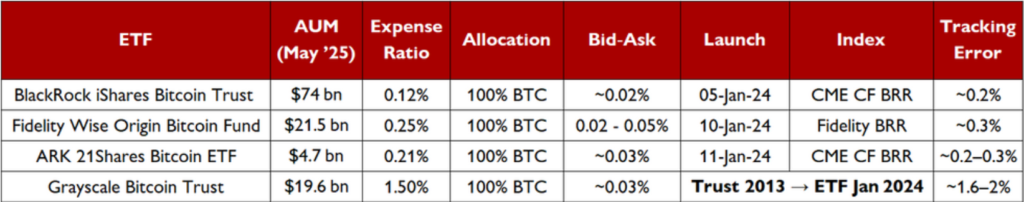

ETFs to Consider:

Below mentioned are some statutorily approved options with relatively large AUMs:

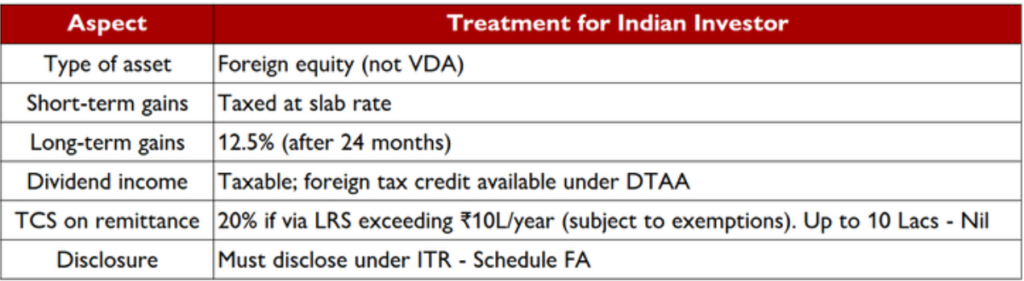

Crypto ETFs Taxation:

Conclusion:

- Bitcoin and Ethereum are emerging as credible diversifiers with strong historical performance

and growing institutional acceptance. - U.S.-listed crypto ETFs offer Indian investors a secure, compliant way to gain exposure.

Limited allocation allows investors to participate in potential upside while keeping downside

exposure in check. - Given the asset class’s inherent volatility, it’s important to approach crypto with prudence and

careful due diligence.

Please note that the above should not be construed as an advice from us. Our company is in the business of distribution of suitable Financial Products to investors describing product specifications, material facts and the associated risk factors. We are acting as a Distributor for these products and facilitating transactions.

Subscribe on LinkedIn