India and the UK have signed a landmark Free Trade Agreement (FTA), expected to boost bilateral trade by $34 billion annually. Despite its breadth — including duty-free access to 99% of Indian exports and exemptions for 75,000 professionals from UK social security — the Indian equity markets fell nearly 1.5% over two days.

The muted reaction may seem counterintuitive, but history tells us markets tend to react cautiously to FTAs, often pricing in expected gains in advance. Let’s explore.

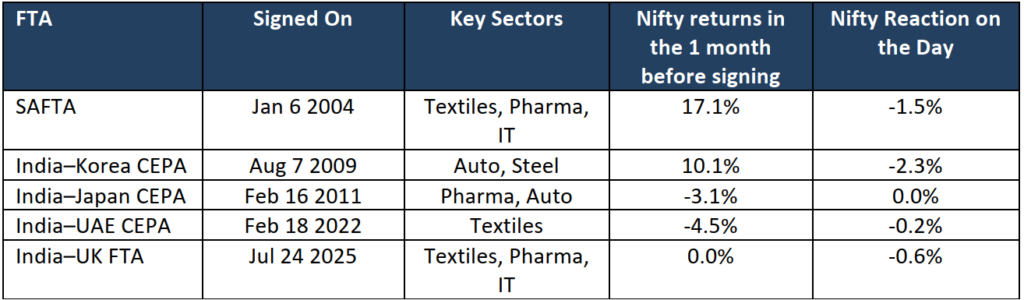

Historical Market Reactions to FTAs:

Markets can sometimes price in the benefits early on and pull back as execution risks and global cues take center stage.

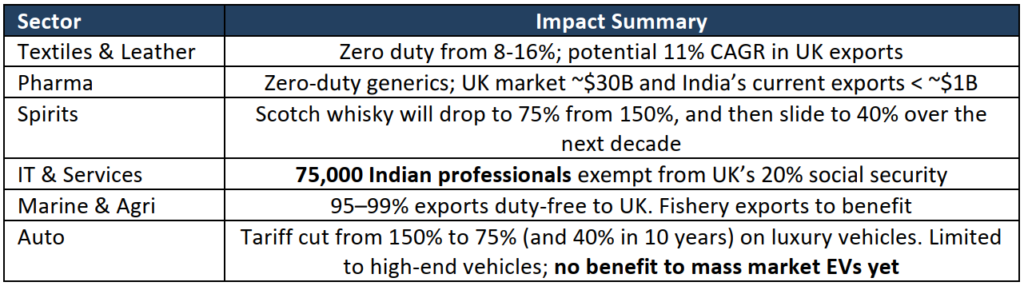

India–UK FTA – Sectoral Impact Snapshot:

Why Markets Reacted Cautiously:

- Select Stock specific Gains were pre-discounted: Stocks like KPR Mill (+26%) & Biocon (+15.4%) rallied to highs pre-announcement and settled down.

- Execution > Headlines: Real benefits depend on regulatory alignment, Logistics & Compliance

Readiness and Slow activation of sectoral quotas not just tariff cuts. - Post-CEPA exports grew at single-digit CAGR over a decade on average, slower than pre-deal

domestic growth (Source: Directorate General of Commercial Intelligence and Statistics (DGCI&S) - Global cues influenced sentiment: Treasury Yield spike, oil rally and possible sanctions on Russian oil

muted domestic enthusiasm

Conclusion:

The India–UK FTA presents a strong structural opportunity, but markets await execution, earnings

upgrades, and visible traction. For patient long-term investors, sector-specific plays in textiles, pharma,

marine, and digital services may offer long-term upside.

Please note that the above should not be construed as an advice from us. Our company is in the business of distribution of suitable Financial Products to investors describing product specifications, material facts and the associated risk factors. We are acting as a Distributor for these products and facilitating transactions.