With recent headlines such as Michael Burry, famous for his 2008 “Big Short” bet, warning that AI may be repeating the dot-com era, and commentary by Ruchir Sharma (via The Indian Express / Fareed Zakaria) asking whether we’re heading for a crash, the rhetoric around the AI boom has turned sharply pessimistic.

Investors today are nervous, stocks of AI leaders like Nvidia and Palantir have dropped, and capex-to-GDP ratios are being compared to the U.S. tech bubble of the late 1990s.

Critics point to aggressive depreciation schedules, rapid hardware obsolescence, and what they call “supply-side gluttony” in infrastructure spending, suggesting the risk of overvaluation could be real.

Yet amid all the panic, the warnings, the short-positions, the headlines, there’s a growing counterargument: that this isn’t a fragile bubble but a deep-seated structural shift. Real demand for AI infrastructure remains robust. Companies are generating free cash flow, building data centers, investing heavily in energy and power, and scaling AI adoption across sectors.

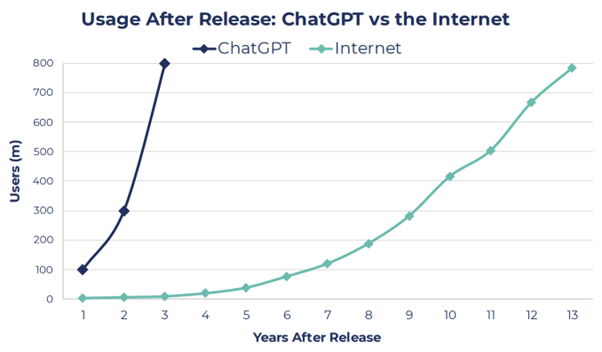

Artificial intelligence has become the strongest force in global markets since 2023, pushing technology stocks higher and forcing investors to confront a big question: Is this a bubble, or is this a genuine economic transformation?

The evidence overwhelmingly points to a boom built on fundamentals, not a speculative bubble.

1. AI Growth Is Built on Strong Fundamentals—Not Hype

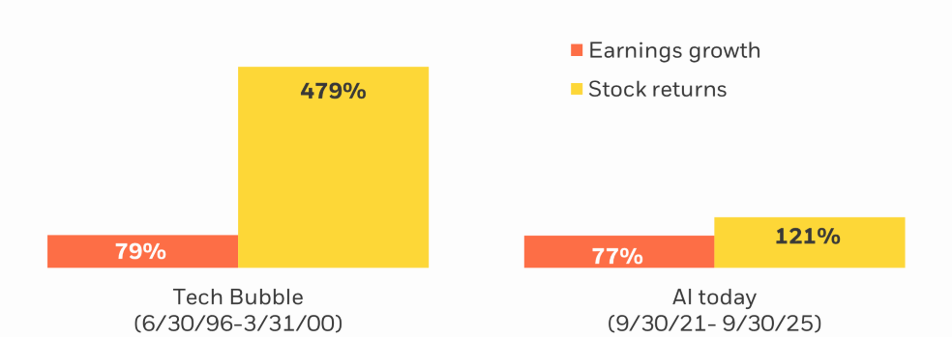

Today’s tech leaders aren’t the loss-making startups of the 1990s.

They are highly profitable, cash-rich, disciplined companies reinvesting out of retained earnings, not cheap debt.

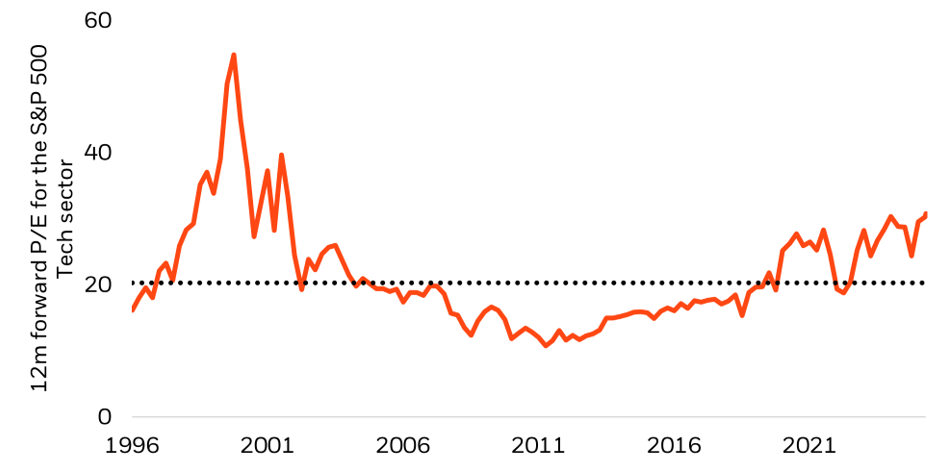

- The S&P 500 tech sector trades around 30× forward earnings

- Dot-com peak was 55×

- AI leaders today have real revenue, real margins, and real pricing power

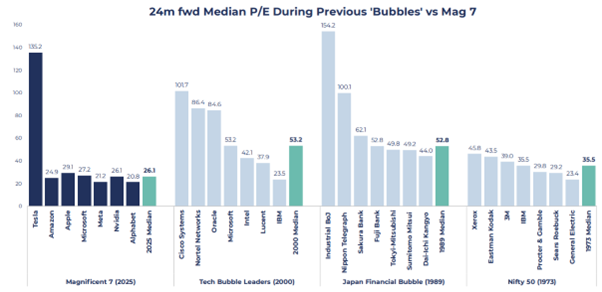

Magnificent 7 (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, Tesla) are a perfect illustration:

They generate hundreds of billions in annual free cash flow and now represent ~35% of the S&P 500, giving them both influence and financial firepower.

Outside Tesla, their forward P/E multiples (median ~26×) are far more reasonable than previous bubble leaders.

Google–Nvidia divergence reflects two different parts of the AI stack: Google is surging on explosive demand for AI inference chips, where its custom TPUs now lead a fast-growing, competitive market. Nvidia’s dip doesn’t signal weakness—its training GPU monopoly remains intact, capacity-constrained, and protected by deep software lock-in and TSMC bottlenecks. As AI adoption accelerates globally, both inference (benefiting Google) and training (benefiting Nvidia) will continue expanding independently.

2. AI Is Now a Physical Infrastructure Build-Out

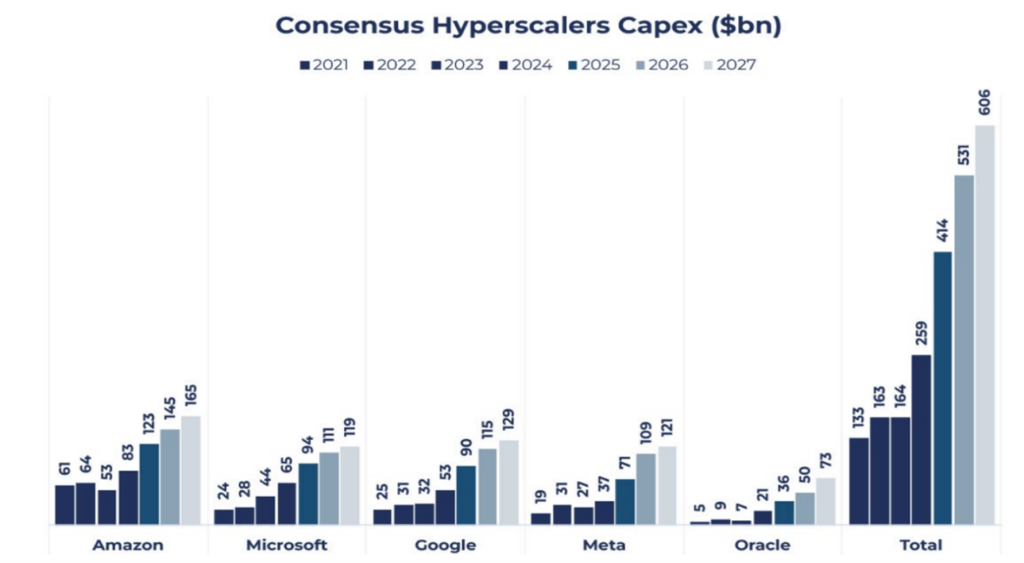

AI demand isn’t theoretical — it is consuming enormous physical resources.

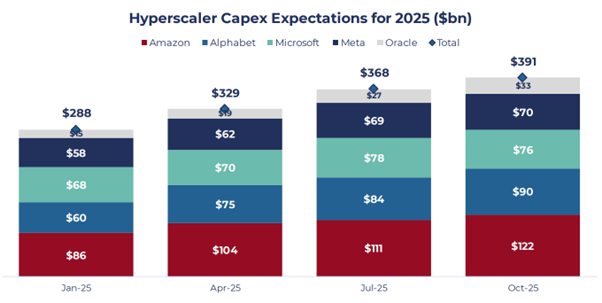

- AI-related spending will reach nearly $400 billion this year

- Data center demand growing 19–22% annually

- AI infrastructure investments contributed over 1% to U.S. GDP in Q2 2025

This Includes:

- Chips (GPUs)

- Data centers

- Power infrastructure

- Cooling

- Cloud networks

Major institutional investors like BlackRock and GIP are now buying data-center operators, construction firms, and even utilities because AI is becoming a massive energy consumer. Nvidia, Microsoft, and others are already investing in multi-gigawatt AI-ready energy capacity.

3. Investor Behavior Is NOT Euphoric — If Anything, It’s Cautious

This is one of the strongest differences vs a bubble.

- U.S. equity funds saw $45B in outflows YTD

- Tech funds saw only $14B in inflows (vs $54B during dot-com)

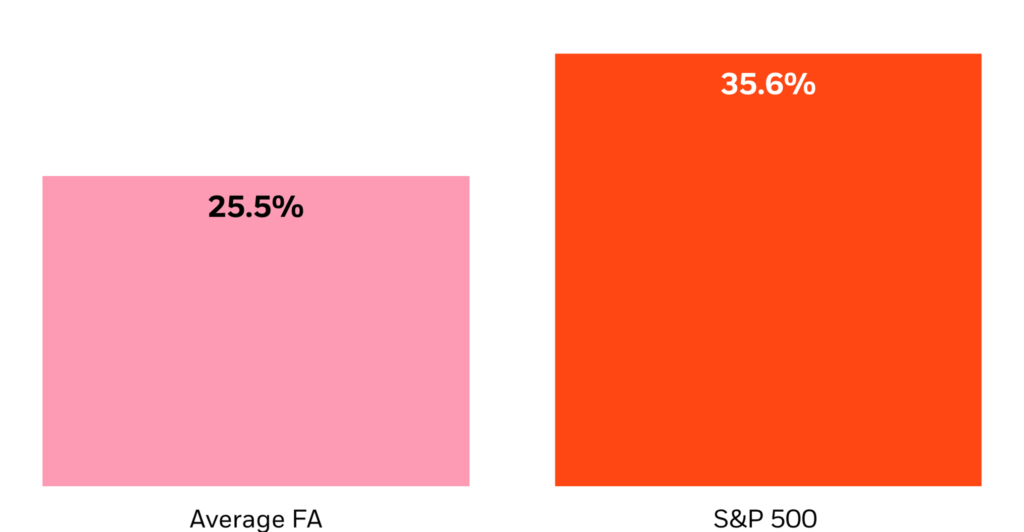

- Average advisor portfolio: 25.5% tech

- S&P 500: ~34.5% tech

- MSCI ACWI: 27.5% tech

From the above it’s clear that many portfolios are still underweight, not overexposed.

4. Why Bubble Fears Exist — And Why They Haven’t Played Out

There are bubble-like elements:

• Hyperscaler capex is rising fast (2025 expected: $288B → $391B)

• Game-theory pushes companies to overbuild compute capacity

• Circular deals (e.g., OpenAI–AMD warrants) introduce systemic quirks

• OpenAI’s $1.5T spending commitments highlight long-term uncertainty

• Some companies (e.g., Oracle) may face near-term free cash flow pressure

But the boom case is stronger:

- Demand > supply

- Early productivity gains already measurable

- Capex is self-financed by giants with strong margins & ROIC

- Magnificent 7 valuations are nowhere near 1999, 1980s Japan, or China 2015 levels

- Infrastructure cycles (railways/telecom) show this level of spending can be absorbed

This is a capital-intensive supercycle, not a speculative mania.

5. Where This Is Heading

AI is shifting into its next phase: the energy + infrastructure era

Big Tech will need: Manpower, more land, more water, more chips and more physical capex

This creates massive opportunities across:

- Semiconductors

- Utilities

- Construction

- Cloud networks

- Power generation

- Data center REITs

- Infrastructure funds

AI is becoming the new industrial revolution, not a fragile bubble.

Subscribe on LinkedInPlease note that this article is incidental to our discussions and nothing in this article should be construed as advice from us. Our Company is in the business of distribution of suitable financial products to investors by describing product specifications, material facts, and associated risk factors. We act solely as a distributor for these products and only facilitate transactions. This content is intended purely for academic and informational purposes.