Since it has been more than nine months from our April 2025 analysis and Bank Nifty outperformed the Nifty 50 by nearly 11%, we thought of revisiting our observations to validate our thesis.

Preivous Blog on Bank NIFTY: Will Bank Nifty Steal the Spotlight from Nifty? – WEALTH FIRST FINSERV LLP

Following are the parameters we considered for validation.

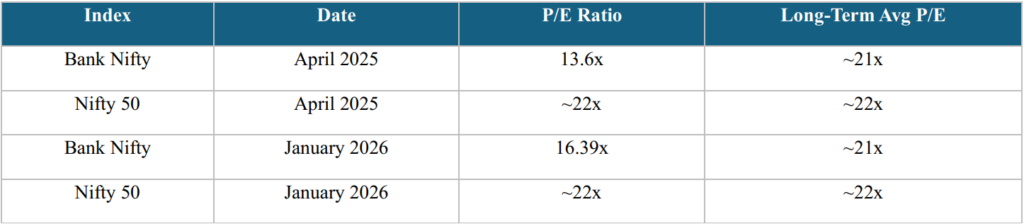

1. Valuation Edge Persists

Bank Nifty P/E ratio in January 2026 still remains below its long-term average.

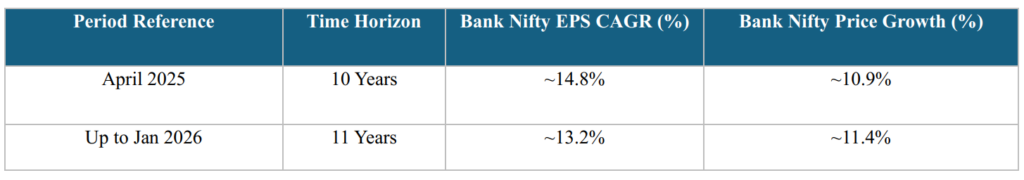

2. Earnings Momentum Has Strengthened

Earnings continued to outpace prices as of January 2026 since our previous observation in April 2025.

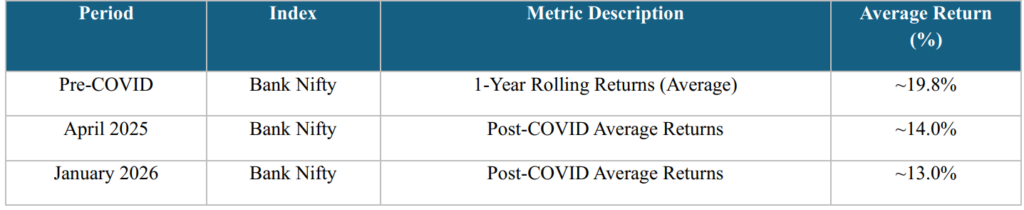

3. Mean Reversion Still Supports Upside

The rebound of the index was strong, but the post-COVID average returns stood at approximately 13% as of January 2026, which still indicates that additional alpha can be generated.

Investment Takeaway:

The April 2025 blog suggested that cheap valuations, steady earnings, and mean reversion have delivered alpha over the Nifty 50. All parameters that suggested Bank Nifty to outperform Nifty 50 are still valid.

Subscribe on LinkedIn

Please note that the above should not be construed as an advice from us. Our company is in the business of distribution of suitable Financial Products to investors describing product specifications, material facts and the associated risk factors. We are acting as a Distributor for these products and facilitating transactions.