In a significant global development, Brent crude oil prices have recently dipped below $70 per barrel for the first time in nearly three years. Market analysts suggest that prices could fall even further, possibly reaching $60 per barrel by 2025 due to a combination of slowing demand and increased supply.

For India, which relies on imports for approximately 87% of its crude oil needs, such a drop in prices could have profound positive effects on various economic metrics, potentially boosting the Indian stock markets as well.

Global Oil Market Trends and Forecasts

- Supply Outlook: Global oil production is expected to rise to 103.2 million barrels per day (mb/d) by 2025, largely due to increasing U.S. output, despite OPEC’s planned cuts in 2024.

- Slowing Demand: Global demand growth is projected to decelerate as electric vehicles (EVs) and renewable energy solutions gradually reduce oil dependency.

How Lower Oil Prices Could Benefit India’s Economy

- Reduction in Current Account Deficit (CAD): In FY 2022-23, India spent $125 billion on crude oil imports. If oil prices drop to $60 per barrel, India could save $25-35 billion annually, cutting the CAD by 0.6-0.8 percentage points.

- Taming Inflation: Cheaper oil reduces transportation and production costs, helping to control inflation. A 10% drop in oil prices typically translates into a 0.4 percentage point reduction in Consumer Price Index (CPI) inflation.

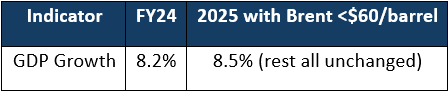

- Boost to GDP Growth: Historically, lower oil prices lead to increased consumer spending, adding 0.3-0.4% to GDP growth.

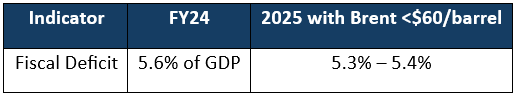

- Reduced Fiscal Deficit: With lower fuel subsidy burdens, the fiscal deficit could shrink by 0.2-0.3 percentage points.

- Stronger Rupee: Historically, a $10 drop in oil prices results in a 1-1.5% appreciation in the Indian rupee. A further decline to $60 could see the rupee strengthen by 2-3%.

Historical Correlation Between Oil Prices and Indian Equity Markets

Periods of declining oil prices have consistently been accompanied by robust market performance in India. Consider these past examples:

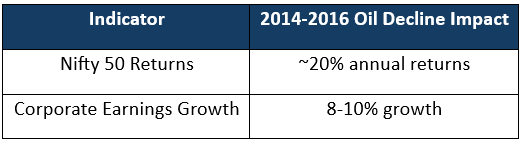

- 2014-2016 Oil Price Drop: As Brent crude plunged from over $100 to below $30 per barrel, the Nifty 50 delivered annual returns of 20%, with corporate earnings growth of 8-10%.

- 2008 Oil Crash: Oil prices collapsed from $147 to under $40 per barrel. By the end of 2009, the Nifty 50 had gained 75%.

Tailwinds in Select Sectors

If Brent crude prices drop below $60, the following sectors are expected to see the strongest benefits:

- Automobiles: Lower fuel prices can improve profit margins. During the 2014-16 oil price drop, the Nifty Auto Index surged by over 40%.

- Aviation and Paints: can also benefit significantly, given their heavy reliance on fuel.

- FMCG: Historically, FMCG stocks have shown resilience, with the Nifty FMCG index rising ~15% during the last oil decline.

Conclusion

A potential drop in oil prices to below $60 per barrel by 2025 could provide a significant tailwind to the Indian economy, curbing inflation, strengthening the rupee, and boosting GDP growth.

Given historical trends, Indian equities could also see strong performance, with the Nifty 50 potentially delivering returns of 12-15%. Sectors like automobiles, aviation, and FMCG are well-positioned to capitalize on this macroeconomic shift, offering investors a favorable outlook.

Subscribe on LinkedIn