Sectoral and Thematic NFOs: A Growing Trend in Investment

Sectoral and thematic New Fund Offers (NFOs) have gained significant traction, especially in high-performing sectors. Since the start of the year, ₹70,000 crore has flowed into these funds, with sectoral funds representing 42% of active mutual fund inflows (Business Today).

- Sectors like infrastructure, manufacturing, and PSUs have delivered over 50% returns in the past year, attracting growth-focused investors.

- Over the past two years, 350+ NFOs entered the market, including 50 sectoral funds (Economic Times, Business Standard), underscoring the rising demand for sector-specific investments.

The Challenge: No Track Record

Despite the excitement around NFOs, a major drawback is the lack of historical performance data, making it difficult for investors to assess their potential.

Which Sectors are Leading the Way?

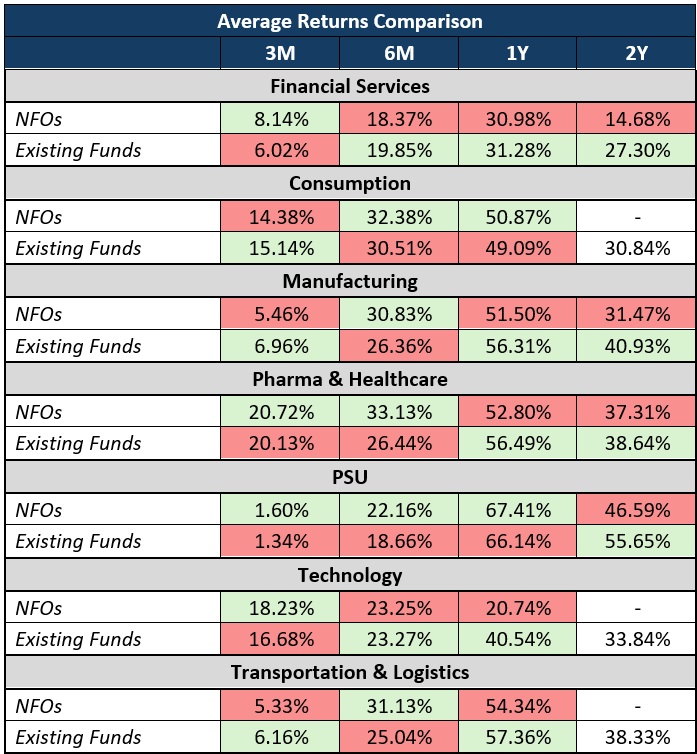

- Sectors like Consumption and PSUs have shown strong performance, with NFOs slightly outperforming existing funds by 2% over a 1-year period.

- However, Funds across other sectors have fared below existing funds with only short-term results more competitive.

The Bottom Line: Navigating Sectoral NFOs

While sectoral NFOs present opportunities in high-growth sectors, they carry higher risk due to the absence of a proven track record. Conservative investors may prefer established funds with consistent long-term performance. NFOs may offer growth potential in select sectors but existing funds provide a more reliable history of returns and risks.

For those seeking stability, sticking with funds that have a proven track record might be a wise choice, especially when there are well-performing alternatives available.

Subscribe on LinkedIn