Broader markets corrected 11.5% since reaching a peak in September 2024, mainly driven by FII selling due to a narrowing India-US interest rate spread and muted corporate earnings (5% YoY growth in the third quarter). However, strong fiscal discipline, controlled inflation (~5%), and domestic investor resilience kept the downside in check thus far. So, the question remains—is this correction nearing its end, or is there more room for markets to fall?

What History Tells Us: A Look at Past Market Corrections

How Does This Correction Compare to Previous Market Cycles?

Since 2000, there have been 10 significant corrections, where the average P/E before correction was 25x and fell to a low of 18x at the end of the correction.

Have Valuations Corrected Enough?

The current Sensex P/E is 21x, above the 18x historical bottom, implying a 10-12% further downside if past trends hold (~67,100 levels).

However, unlike past major crashes (2008 crisis, COVID crash, or taper tantrum), this correction lacks a severe external trigger, meaning markets could stabilize and recover without deeper cuts.

The Payoff at Lower Valuations

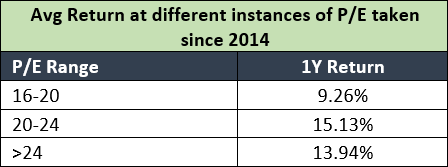

By analyzing 132 instances of Sensex P/E since 2014, the following trends emerge:

The average 1Y Return when invested at a P/E in the range of 20x to 24x is at ~15%. In fact, over the past decade, investments within the 20-21x P/E range have yielded the highest one-year returns among the three evaluated P/E ranges. Also, Table 1 shows that the average post-correction 3Y CAGR has been 25%, making corrections an opportunity for long-term investors.

Final Takeaway: A Time to Accumulate?

With markets either close to a bottom or in a time correction phase, this could be an opportunity to accumulate rather than panic. Historically, market downturns have been followed by strong recoveries, and with domestic fundamentals intact, a bounce may not be far away

Please note that the above should not be construed as an advice from us. Our company is in the business of distribution of suitable Financial Products to investors describing product specifications, material facts and the associated risk factors. We are acting as a Distributor for these products and facilitating transactions.

Subscribe on LinkedIn