Individuals and HUFs can claim deduction up to Rs. 1,50,000 from their gross total income for certain investments/payments made in schemes specified under Section 80C of Income Tax Act, 1961.

Some of the popular schemes under section 80C are:

- Public Provident Fund (PPF)

- Employees’ Provident Fund (EPF)

- National Savings Certificates (NSC)

- Life Insurance Policy (LIP)

- 5 year Bank Deposit schemes (Bank FD)

- Post office Savings Scheme

- Sukanya Samriddhi Yojana (SSY)

- National Pension System (NPS)

- Equity Linked Savings Scheme (ELSS)

Among these, PPF is a preferred tax saving scheme. From the perspective of liquidity and return on investment, we compared Equity Linked Savings Scheme with PPF as ELSS is being preferred by new generation investors.

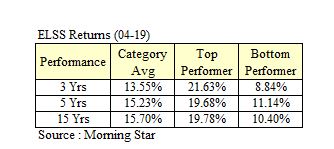

Performance of ELSS Vs PPF:

ELSS: Equity Linked Savings Schemes (ELSS) are floated by Mutual Funds. At least 80% of the total assets are invested in equity and equity-related instruments.

Across all time periods i.e. 3, 5, and 15 Years – ELSS had outperformed PPF historically.

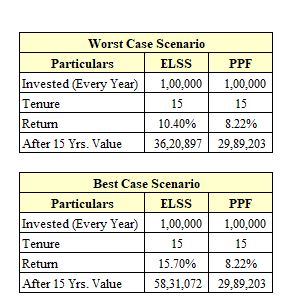

Worst and Best Case Scenarios:

Observation:

- It can be seen from the above data that even the worst performing ELSS had given better returns than PPF.

- Post tax returns of ELSS still outperformed PPF returns.

- ELSS has the lowest lock in period of 3 years as compared to PPF 15 Years.

Disclaimer: The information, analysis and opinion contained herein pertain only to Market price action for the specified period. The same, (1) do not constitute investment advice offered by the issuer, (2) is solely provided for informational purpose and therefore is not an offer to buy or sell securities, (3) is not warranted to be correct, complete or accurate, (4) may not be copied or redistributed, (5) This report is an intentional literature, intended for information purposes only. The issuer shall not be responsible for any trading decisions, damages or other losses resulting from, or related to this information, data analysis and opinion or their use in any way.