Is it prudent to invest in Equity Markets during an election year?

This doubt is lingering in the minds of many an investor. It stems from the fact that markets largely turn volatile during such events and investors become jittery even when their investment horizon is long term.

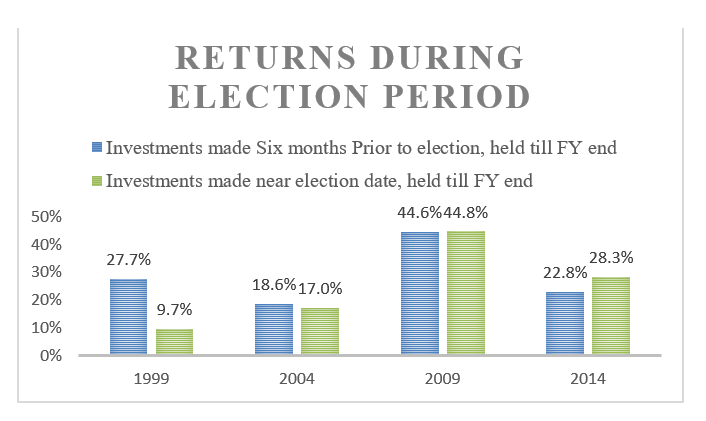

It would be good to see some interesting aspects of market behavior using Nifty 50 index as proxy during previous elections which are illustrated below:

Whenever a stable Government was formed by any party, markets gave handsome returns during the immediate one-year period post elections.

While market swings in the short term depend on the outcome of elections, markets in the long term take a cue from the macros like rate of growth, GDP, inflation etc. While there could be knee jerk reaction to poll results, markets generally recover quickly once they get the comfort of stability plank of the party in contention to form the Government.

One can observe that in last four general elections, investors benefited by investing in election year.

Even in the long term, markets (Nifty 50 index) delivered handsome returns from one election term to another.

During the entire 5 years tenure, equity markets gave a compounded aggregate growth of 10.5% to over 16% beating most of the other asset classes.

Disclaimer: The information, analysis and opinion contained herein pertain only to Market price action for the specified period. The same, (1) do not constitute investment advice offered by the issuer, (2) is solely provided for informational purpose and therefore is not an offer to buy or sell securities, (3) is not warranted to be correct, complete or accurate, (4) may not be copied or redistributed, (5) This report is intentional literature, intended for information purposes only. The issuer shall not be responsible for any trading decisions, damages or other losses resulting from, or related to this information, data analysis and opinion or their use in any way.