Volatility in stock markets though worrying, is not new.

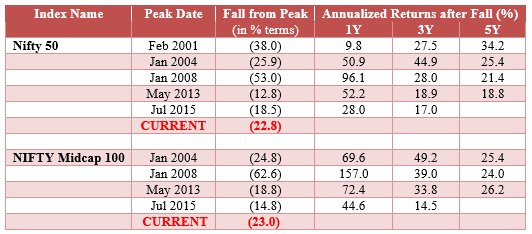

Over last 20 years, we have seen several drawdowns (fall from the peak) of similar nature of what we saw over last few days. We thought of providing data from a historical perspective.

Historical data-points are supportive for long-term Investors.

Markets have given strong returns post sharp falls.

Valuation Support (Historical measures)

Price to Earnings ratio and Price to Book ratio suggest valuations are cheap. This is a pure valuation-based measure and looks at historical valuation trends to create BUY/ SELL triggers.

The markets are currently very close to BUY Zone (8 – 10% away).

Outlook

Markets are discounting negatives (i.e. Global recession, rapid spread of Corona). But once markets calm down, macros come into play. Investors may start looking at the following:

- Advantage of the lower Oil prices for India (Lower current deficit, low inflation).

- Benefit of lower trade deficit with China and some business getting diverted to India in the long-term.

- Easy domestic liquidity and lower interest rates, locally and globally.

- Risk-off sentiment will stabilize soon. When that happens, India is likely to emerge as an attractive long-term destination.

We would like to caution that increased volatility is expected for at least another month and we do not expect a sharp near-term bounce-back.