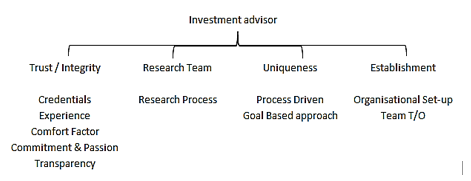

Health and Wealth are undoubtedly the most important aspects of material world. When it comes to health, we certainly want the best treatment for ourselves, thereby fulfilling our Health wellbeing. But most of us ignore the second equally important aspect of Wealth wellbeing. Not only first-time investors but also seasoned professionals, owing to limitation of time and other resources, find it difficult to manage finances and face difficulties in aligning resources to meet up financial goals. This is where financial advisors come into picture. What should be the attributes you should investigate (especially the millennials) while scouting for a Financial / Investment Advisor.

Trust & Integrity

- Trust is an essential component of any relationship, especially when it comes to money matters!

- Start your search for advisor by acknowledging the credentials / designations / certifications the team members hold. This in turn helps you not only understand the academic strength but gives an oversight in to what organization rules & laws are governing the Team members.

- Acknowledging the Team experience is perhaps the most important aspect. In todays age, it is not uncommon for financial advisor setups to be undone in short span of time.

- Advisor should be able to empathize with you and guide and impart financial literacy to you during the process.

- Good advisors are passionate about empowering their investors to achieve their financial goals. Commitment and passion should not only be apparent in the first meeting but in every interaction, you have with them.

- Understanding the fundamental nature of your Investments including the risk – return profile along with the fee structure. You need to understand the financial relationship between your advisor and investing vehicle for e.g., is advisor getting additional revenues for subscribing you to any specified services.

Research Team

- Ensure the advisor organization has dedicated research team ensuring the soundness of recommended products. Given the complexities of products it becomes difficult for non-financial background people to appraise the risk associated with financial products.

- Understand the research process of the organization.

Uniqueness

- Since no 2 people will have same financial situations, there cannot be a “tailor made” solution. A good advisor would be able to distinguish between your “willingness” to take risk, and your financial preparedness/ability to take such risks. Optimal trade off between “willingness” and “ability” to take risk should help you achieve your goals.

- ALWAYS MAP YOUR INVESTMENTS TO FINANCIAL GOALS e.g., Children education, retirement corpus etc. Investing without a goal would defeat the purpose of disciplined investing.

Establishment

- Be certain about the organizational set up the advisor operates in.

- Take into consideration the team churn rate of the organization.

Please note that the above should not be construed as an advice from us. Our company is in the business of distribution of suitable Financial Products to investors describing product specifications, material facts and the associated risk factors. We are acting as a Distributor for these products and facilitating transactions.