With rising interest rates, one would expect a natural attractiveness towards the debt market. However, June has seen an outflow of Rs. 87,000 crores in debt mutual funds alone. This doesn’t mean that the trend is reversing; rather it shows the impending liquidity constraint in the market and increasing demand for short-term money requirements.

Now that this fact is established, our focus should be on the attractiveness of debt markets in current scenario and investment in which tenor would prove fruitful.

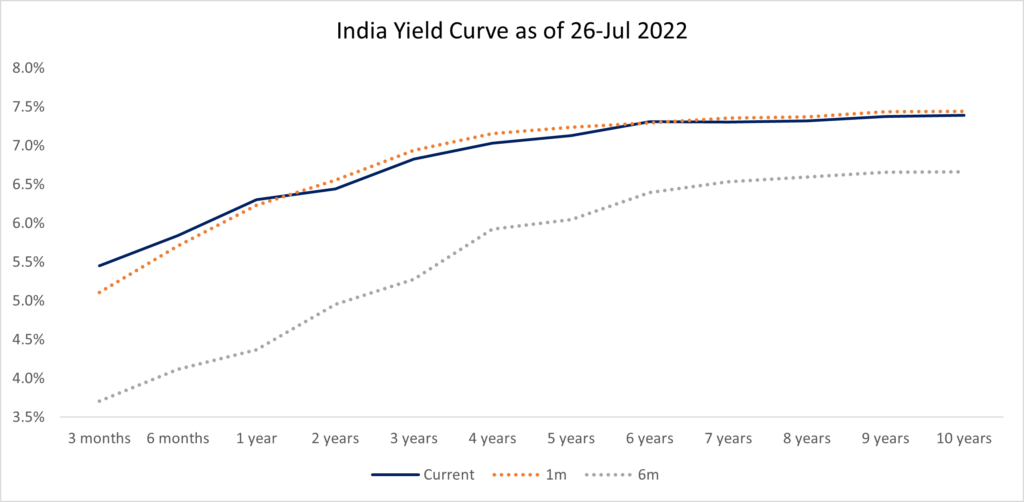

We would first need an understanding of the present yield curve to analyze the above. Shown below is the India Yield curve for June 2022.

Short term rates (3M to 1 year) moved up considerably as inflation went up and RBI started to increase the overnight rates.

Even the long maturity 5 year and 10-year interest rates moved higher and are at 7.14% and 7.40% pa respectively.

Higher yields always present an opportunity for mutual fund investors in two segments: a) higher accrual and b) potential capital gains when the interest rates drop to lower levels.

If an investor is looking to receive accrual of 6.5%, they may look at investing in short term funds which invest in bonds maturing in about 3 years. These funds may provide higher than 6.5% return if the short-term rates drop in next 12 months.

Similarly, long term bond funds, Gilt funds and Constant maturity treasury funds provide to lock in accrual of 7.4% with potential gains on rates coming down. In this case, funds may provide 10% return in one year if the 10-year bond yields drop from 7.4% to 7% during the period.