Many make the mistake of buying an insurance policy with an eye on the income it generates. It is natural to expect something in return for the money spent on buying a policy. But one should be clear about why insurance in the first place. Insurance is to protect your loved ones when you are not around. One should accept this fact of life. A term insurance is the cheapest of all and covers you for much higher amounts at much lower premiums.

Insurance as an investment vehicle is not very wise and may prove expensive. Let’s put some figures to understand better.

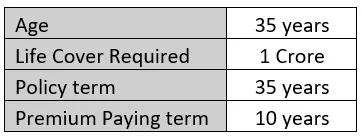

X (aged 35) is working in an MNC with an annual pay of 10 lacs. X wants to purchase a life insurance policy and is exploring various options to find the best one. This is how a traditional insurance policy looks:

“X can get the dual benefit of protection plus investment returns with a single policy. All he must do is pay an annual premium of say, 1 lac, for 10 years and the policy term is about 35 years. The sum assured on death is 10 times the annual premium, 10 lacs in this case. X gets an income every year from age 47 to 76, and a lumpsum amount on maturity.”

X feels pretty good about this deal. However, X missed the following crucial aspect regarding insurance policies in general.

X who has a 10-lac annual pay would require a sum assured of at least 1 crore (not considering the effects of inflation and other costs) to provide adequate coverage for his family to lead a similar lifestyle.

X could instead purchase a pure term insurance which would give him the required 1 Cr cover at far lower premiums (say Rs 35000/- per annum for a limited policy payment period of 10 years) and invest the rest in an appropriate asset class, say a conservative mutual fund scheme to achieve inflation beating returns.

Let us understand it with an illustration:

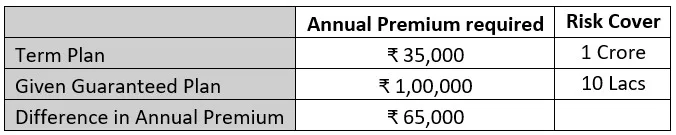

The annual premium required for different policies is:

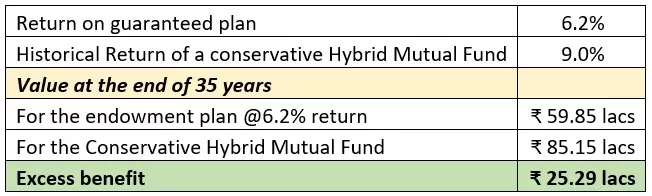

Here, the guaranteed plan generates a return of just 6.2% that too with 1/10th the cover of the term plan.

By investing the difference in premiums of Rs. 65,000/- in even a conservative scheme of a Mutual Fund, X would gain over Rs. 25 lacs during the same term along with a 1 crore life cover from the term plan. The excess return realised is 2.8%.

X would reap even more benefits by investing in slightly aggressive mutual funds which can generate a return of 12% or more according to his risk profile.

Now we must note that 6.2% for a traditional insurance policy is at the higher end of the return spectrum, with most hard selling policies giving a return in the range of 3%-6%.

By opting for a pure term insurance (which is a necessary expense) and investing the surplus from the premium, the investor could realise the dual benefit of life cover along with wealth creation.

Hence, it must be understood that many traditional life insurance policies neither generate meaningful returns over the long- term nor provide an adequate life-cover.

Disclaimer: Please note that the intention of the blog is to highlight the advantage of using a pure term insurance and an appropriate asset class where premium saved over a traditional policy can be invested for wealth creation. Depending on the risk profile and saving and spending habits, guaranteed and other traditional policies may also be needed for assured income. It in no way suggests that other traditional policies are not required in a financial journey.