“We steer clear of the foolhardy academic definition of risk and volatility, recognizing, instead, that volatility is a welcome creator of opportunity.” Seth Klarman

This is true for 99% of investors. Most shy away from the stock market in view of the notion that the market is very volatile and risky. Firstly, we must try to separate risk and volatility as two distinct terms. Volatility in markets could give us numerous opportunities of generating better returns and thereby higher performance over time. Risk, on the other hand, could be treated as an ill-conceived investment.

To illustrate this concept further, consider the following scenario:

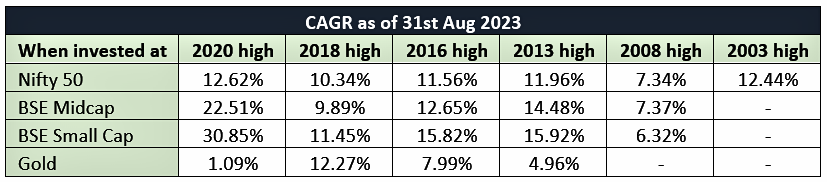

Imagine you made a single investment at the market’s peak, whether it was three, five, or even twenty years ago, and you’re now assessing the returns as of 31st Aug 2023. Here are the results, indicating the Compound Annual Growth Rate (CAGR) when invested at different market peaks:

Despite investing at peak, Nifty has given nearly 12% since 2013 (nearly 10 years), while Mid and Small caps generated over 14% returns in the same period.

These figures further demonstrate how market volatility, when approached strategically, can lead to favorable returns over various investment horizons.

Also, since picking individual stocks needs both skill and time, investing through Mutual Funds could be considered.

Now let us compare how equity markets fared in comparison with other traditional avenues:

While FDs and PPFs are preferred choices due to the risk-free nature, most investors also prefer investments in real estate citing the capital appreciation of the asset and the attraction of owning a physical asset.

Although real estate investment is necessary, considering it to be less risky than the stock market is debatable. Physical Real Estate investment comes with the risks of liquidity, opaque pricing, high costs associated with property maintenance and risk of prolonged periods of non-occupancy. While Mutual Fund investments are volatile in the short term, they have given consistent returns in the longer term and are very liquid. Mutual Fund holding cost is low, pricing is transparent and is tax efficient compared to real estate.

In fact, let us see how apartment rates have appreciated on an average in the last 5 to 10 years in Hyderabad region. Around 110 localities have been considered for this purpose and the average annual appreciation is appended below:

5 Years: 12.80%

10 Years: 6.26%

The price appreciation of real estate is less than that of Nifty 50 in the last 10 years. This is despite investment in real estate being considered at an average price and not at the highs unlike Nifty.

It’s essential to recognize that while volatility may introduce short-term fluctuations, a well-considered investment strategy can help manage and potentially leverage this volatility to your advantage.

Hence, we could, with a degree of comfort, conclude that Mutual Fund investment may generate better returns if held for longer periods and the notion that it is riskier than most traditional investments is not true.