Majority of Indians living abroad find themselves at crossroads when it comes to long-term investments. The pivotal question is whether India offers superior returns compared to the United States. Additionally, concerns loom over rupee depreciation and its impact on returns in dollar terms and post-tax returns. This article aims to simplify these issues and help you understand your investment returns more clearly.

Investment Returns: The Consistency Check

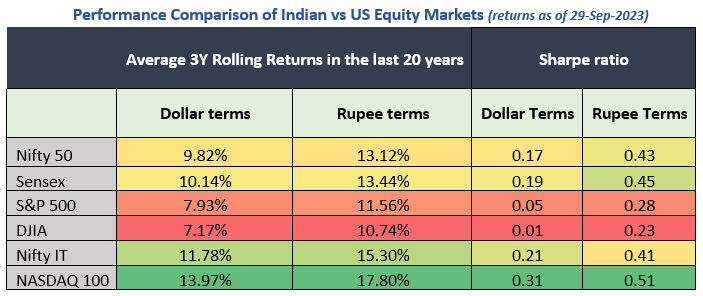

To shed light on the consistency of investment returns, we delved into 20 years of data, focusing on rolling 3-year returns.

Unlike point-to-point returns that gauge performance in specific periods, rolling returns measure the average consistency over longer periods.

The findings are clear – Indian equity returns, both in rupee and dollar terms, surpass the US indices. Even on a risk-adjusted basis, India emerges as the superior choice.

Exchange Rate Resilience

Worried about rupee depreciation? Fear not. Even after adjusting for an average rupee depreciation rate of 2.3% (based on historical records) per annum, Indian benchmark indices have consistently outperformed the US markets. Notably, Nifty IT holds its ground alongside the NASDAQ 100. This resilience is seen in both rupee and dollar terms, highlighting the low impact of exchange rate volatility on performance.

Taxes and Repatriation: A Win-Win for NRIs

Taxation on equity investments for Non-Resident Indians (NRIs) mirrors the rates for domestic investors. Short-term capital gains (for investments held for less than one year) are taxed at 15%, while long-term capital gains exceeding INR 1 lakh face a 10% tax. India’s Double Tax Avoidance Agreement with approximately 85 countries, including major economies, ensures investors won’t be taxed twice – once in their country of origin and once in their resident country. Plus, there’s no limit on how much money you can take back from your NRI investments.

India’s Bright Future: What Experts Say

If lingering concerns about investing in India’s booming economy have held you back, recent developments should put your mind at ease:

“The IMF projects India’s economy to surpass $5 trillion by 2026-27, along with the ascent of a trillion-dollar digital economy.

Morgan Stanley declares it as “India’s decade.”

JP Morgan integrates Indian bonds into its Global EM index.

CLSA upgrades India to a “20% overweight” stance.

BCG describes India’s transformation in less than a decade as stunning.

India stands at the cusp of an economic boom. Its strides in Infrastructure, Manufacturing, and Digitalization make it one of the most enticing Emerging markets today, as market experts affirm.”

Seizing India’s Promising Opportunities

In conclusion, history attests to the promising investment opportunities in Indian equity markets. What’s even more appealing is the current scenario, where India’s ongoing transformation could lead to significant returns for investors Don’t miss out on India’s investment potential; it’s a journey worth embarking upon.