As India gears up for its 18th general elections, investors are understandably adopting a cautious stance, given the historical volatility experienced in the run-up to and aftermath of these significant political events. To help you make informed investment decisions, we’ll delve into past election cycles and their impact on the financial markets.

Reviewing Elections from 1996 Onward

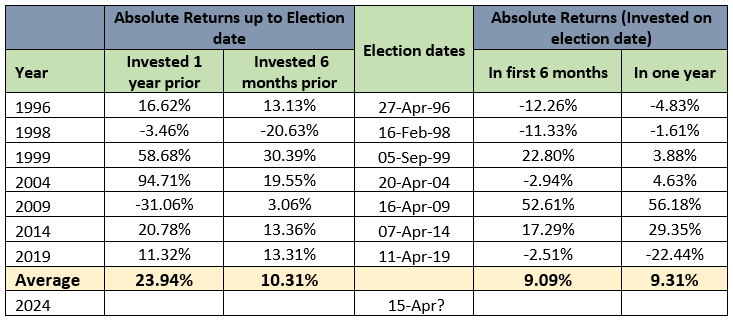

We’ll begin by examining market returns (with actual numbers) during previous general elections in India from 1996 to understand and appreciate the pattern.

While the 1996 election results led to a hung parliament thereby leading to weaker markets, the 1998 election was unique, taking place mid-term and coinciding with the Asian Financial Crisis. The year 2019 was also an exception, with negative returns of 22%. This could be attributed to the steep COVID fall in April-May 2020.

Analyzing Market Performance:

- Pre-Election: Amount invested Pre election (Returns up to Election date)

- Average returns for investments made one year prior: 23.94%

- Average returns for investments made six months prior: 10.31%

- Post Election: Amount invested on Election Date (Returns post-election)

- Average returns after 6 months: 9.09%

- Average returns after one year: 9.31%

Now, if we consider an investor (say A), investing 6 months prior to each of these election dates while withdrawing one-year post-election dates, A’s returns would have averaged an impressive 29%.

This could also mean that while caution should always be exercised, completely staying away from investments citing elections may not be prudent as there might be an opportunity loss as well.

It would be interesting for readers to note that Two negative returns in 1998 pre-election and 2019 post-election are more attributable to external factors with 1998 witnessing Asian crisis and post 2019 period witnessing COVID sell off.

For savvy investors, the historical trends offer valuable insights into navigating the investment landscape around general elections in India.

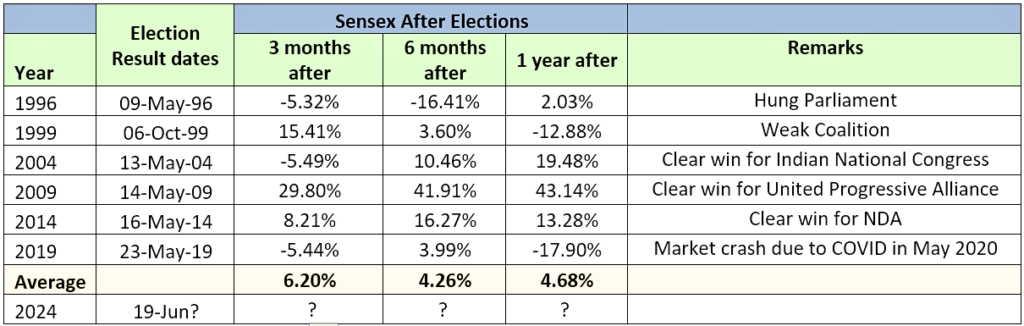

As an addendum, we have also analyzed how markets have performed 6 months and 1 year post the election results have been announced. With the election result date looming just over a month away, this analysis could provide valuable insights for investors aiming to make well-informed decisions.

As can be seen, markets tend to perform whenever there is a decisive mandate irrespective of near-term volatility.