Debunking the Myth of FII Control:

Foreign Institutional Investors (FIIs) were once seen as the market movers, capable of driving trends through their massive investment capacity. However, the landscape of market influence has significantly broadened, with various other factors shaping price movements and investor sentiment.

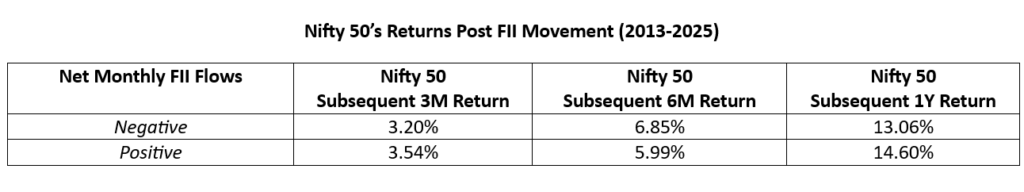

Now, it hardly matters whether FIIs are buyers or sellers – their direction of flow no longer dictates the market’s course.

Nifty’s Resilience Amid FII Volatility:

This illustrates that Nifty 50’s performance is almost symmetrical, irrespective of the direction of the flow. Despite the volatility exhibited over the past decade, Nifty 50 has demonstrated remarkable resilience, due to the strong role played by Domestic Institutional Investors (DIIs) in neutralizing FII flows.

DIIs Are The New Pillars of Stability:

Despite FII net outflows in 9 out of the 13 observed instances, the benchmark index has rallied consistently – indicating that foreign selling does not dictate market trajectory as commonly perceived.

DIIs have been taking a more active role in the recent years and helped keep the market steady when foreign investors pulled back. Since 2015, DII participation has grown over ~320%, and as of March 2025, they hold a 17.62% stake, surpassing FIIs at 17.22%. DIIs have effectively counterbalanced foreign volatility, helping maintain price stability and investor confidence during global disruptions.

Conclusion – A Maturing, Self-Reliant Market:

As FIIs are becoming less relevant, the Indian equities are charting their own path. The baton has passed on to domestic investors, whose consistency and depth are shaping a more stable, confident, and fundamentally driven Indian market.

Please note that the above should not be construed as an advice from us. Our company is in the business of distribution of suitable Financial Products to investors describing product specifications, material facts and the associated risk factors. We are acting as a Distributor for these products and facilitating transactions.