What gave birth to ESG considerations?

Many risks associate with Financial Investments, some of them are relatively difficult to quantify. One of them is “Climate risk” (CR). In simple terms, CR is the measure of “carbon footprint” on nature because of activities carried out by businesses.

What are ESG Considerations?

ESG consideration are non-financial performance indicators. The following constitute major considerations:

- Environmental risks – business activities that have actual or potential negative impact on air, land, water, ecosystems, and human health.

- Social risks – business impact on society. Considers attributes of health and safety, labor-management relations, protecting human rights, and integrity.

- Governance risks – concern the way businesses are run. Addresses corporate independence and diversity, corporate risk management culture, accountability of the board, protecting shareholders and their rights.

What entails ESG Investing?

ESG investing seeks not only financial returns but the impact the investments have on the global issues such as global warming. Millennials are particularly attracted to investing in companies that adhere to ESG norms. They are conscious about their role in environmental and social responsibility and are looking to invest in companies that adopt environment friendly policies or bring in products or practices that influence society positively.

Future of ESG Investing world & India!

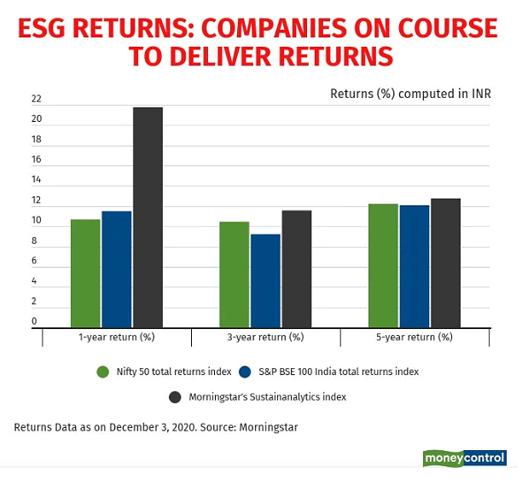

Global assets under management (AUM) with ESG portfolios hit a high of US$1.2 trillion in October 20 – a quantum increase from $530 million five years ago. Bloomberg reports state that there were 17 ESG exchange traded funds rolled out so far in 2020, compared with 10 in all of 2019.

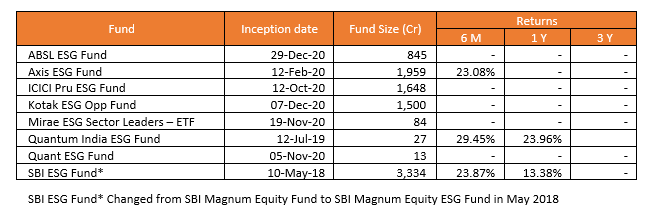

In India however, ESG investments are still at a nascent stage. While there are 3500+ Global ESG funds, In India we have only 8 funds with 6 funds rolled out in Year 2020. It is expected that in future, foreign inflows into companies adhering to ESG considerations would be manifold as already witnessed in Global markets.

ESG Investing options in India.

ESG investments would become the trend in coming days. Investors can look at this theme as it gives them the satisfaction of contributing to the ESG cause while getting a decent return on their investments. Appending the list of ESG funds in India.

Please note that the above should not be construed as advice from us. Our company is in the business of distribution of suitable Financial Products to investors describing product specifications, material facts, and the associated risk factors. We are acting as a Distributor for these products and facilitating transactions.