Most of the retirement planning is done assuming a certain inflation rate and the required corpus is arrived at. However, average inflation may not remain in the range we anticipate.

If one does revise it to current inflation, it will adversely affect the post retirement lifestyle as the retirement corpus may not help sustain the desired lifestyle. One may have to either cut down the expenditure post retirement or increase the amount of savings pre-retirement. In such a scenario, it is always prudent to understand how a marginal increase in inflation impacts one’s monthly expenses/savings.

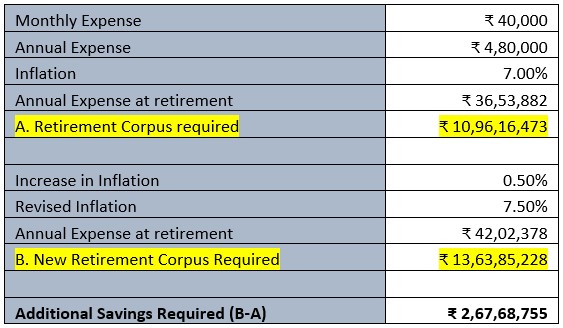

Let us consider a scenario as given in the table. For a person whose current monthly expense is Rs. 40,000 and who is to retire in 30 years, the retirement corpus required is Rs. 10.96 crores if average inflation remains at 7% during pre-retirement years. Effect of a 0.5% increase in inflation would be:

One needs to make an additional monthly savings of Rs. 11,750/- to meet this corpus for the next 30 years, assuming an average return of 10% pre-retirement.

Thus, increase in inflation not only reduces the purchase power of a consumer, but it also forces a consumer to save more for retirement. Clear Double Whammy