“Investing is the age-old, never-ending emotional battle between fear of the future and faith in the future” – Nick Murray.

However, fear of the future almost always takes the front seat and leads us to react to market conditions in ways we do not want to. Riding out these emotions can be effectively done by long-term investing.

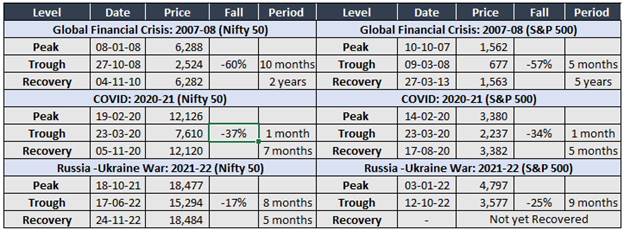

Let us consider the following economic crises where the Indian markets crashed but bounced back subsequently. In all these cases, markets withstood these shocks and recovered within a span of 1 to 2 years and performed well in the subsequent years.

In fact, the recovery periods are shortening in the recent years, with Indian markets recovering faster than the US counterparts.

Additionally, one should also consider India’s relative advantage in the global market due to the following factors:

- Demographic advantage – Median age in India is 28 years and is a huge base for consumption.

- Robust domestic demand.

- Fastest growing major economy of the world and is expected to be one of the top 3 economic powers in the next 10-15 years. Expected to surpass Japan & Germany by 2027.

- Clocked 5.5% average GDP growth in the past decade.

- “Tighter global labour markets and the emergence of distributed work models are bringing new momentum to the idea of India as the back office to the world”, according to Morgan Stanley

- Robust Credit Growth, developed markets looking at an alternative to China, Russian Oil discounts, and a strong retail investor presence.

While there may be geo-political events, sticky inflation, and the possibility of recession affecting the performance of markets in the short run (1 to 2 years), in the longer term, markets will bounce back as India growth story is intact. So, staying invested in the long-term always benefits.