As we approach the conclusion of the financial year on March 31st, prudent tax planning becomes imperative, particularly for salaried individuals confronted with the choice between the old and new tax regimes.

Evaluating Tax Regimes: A Calculative Approach

In the realm of tax obligations, selecting between the old and new tax regimes demands a meticulous assessment. Firstly, this requires identification of the various tax-saving options available under both regimes. Let us explore them below.

Old vs. New: Unravelling Deduction Dynamics

Under the old tax regime, a spectrum of deductions is available, encompassing the Standard Deduction, Section 80C, Section 80CCD (1b), Section 80CCD (2), Section 80D, HRA Tax-Exemption, and Interest on Home Loan (Section 24). Each deduction serves a distinct purpose, catering to various financial circumstances.

- Standard Deduction (Rs 50,000): Salaried individuals receive a deduction of Rs. 50,000 from salary income without any documentation.

- Section 80C (Rs 1.5 lakh): Deduction for specified investments and expenses, reducing taxable income. Instruments include EPF, PPF, tax-saving FD, Specified Mutual Fund Schemes (ELSS), and certain expenses like school fees and life insurance premium.

- Direct NPS Deduction: Section 80CCD (1b) (Additional Rs 50,000): Extra deduction for direct NPS investments, over and above Section 80C.

- Indirect NPS Deduction: Section 80CCD (2): Employee can claim a deduction for employer contributions to NPS, up to 10% of salary (14% for government employees).

- Section 80D (Health Insurance Premium): Deduction for health insurance premium based on age: Rs 25,000 (below 60 years) or Rs 50,000 (senior citizens). Additional deduction for parents, resulting in a maximum deduction between Rs 50,000 and Rs 1 lakh.

- HRA Tax-Exemption: Eligibility for tax exemption on HRA if an individual is living in rented accommodation. HRA is calculated as the lowest of the following:

- Actual HRA received by the employee.

- 50% of (basic salary + DA) for those living in metro cities (Delhi, Mumbai, Kolkata and Chennai).

- 40% of (basic salary + DA) for those living in non-metros.

- Actual rent – 10% of (basic salary + DA)

- Interest on Home Loan (Section 24):

- Deduction on interest paid on housing loan for self-occupied property is up to Rs 2 lakh.

- For property, which is let-out for rent, there is no upper limit on the tax-exemption that can be claimed, and deduction can be claimed on the entire interest paid.

Deduction Under New Tax Regime:

- Indirect NPS Deduction: Section 80 CCD(2) (Linked to NPS Employer Contribution): Maximum deduction is 10% of salary for private sector employees and 14% for government sector employees. Other common deductions are not applicable under the new tax regime for FY 2022-23.

Understanding which tax-regime is beneficial:

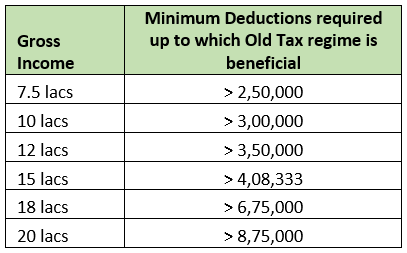

The breakeven point for deductions at different income levels for choosing the tax regime is shown below. The assumption is that the employee is only able to avail the already available std deduction in the New Tax regime. Beyond the threshold shown below, both regimes yield identical tax liabilities.

Let’s break it down:

If someone earns ₹10 lakhs a year, sticking to the old tax regime saves money only if they can save more than ₹3 lakhs in deductions. Similarly, if someone earns ₹18 lakhs annually, the old tax rules are better only if they can claim deductions above ₹6.75 lakhs.

- However, most salaried workers usually have only a few deductions, such as 80C (up to ₹1.5 lakhs) and 80CCD (1) (up to ₹50k) for NPS. Together, these add up to ₹2 lakhs. Including the standard deduction of 50k, the maximum deductions that most individuals claim is not more than 2.5 lacs.

- Under these circumstances, sticking to the old tax regime is only better if their salary is below ₹8.75 lakhs. Beyond this, the new tax regime makes more sense.

- It is also seen that the new tax regime becomes more beneficial as the income increases and the options for deductions that can be claimed become limited.

In conclusion, as the financial year concludes on March 31st, meticulous tax planning is not merely a procedural task but a strategic endeavour. The selection between tax regimes and the judicious utilization of available deductions warrants careful consideration, ensuring optimal financial outcomes.

To optimize your tax savings, Click Here to delve into our addendum to this blog. Inside, you’ll discover valuable insights on leveraging more deductions using both HRA and Interest Paid on Home Loan.