As an addendum to our previous blog Tax Planning Strategies in the Final Stretch of the Fiscal Year, we can consider two more deductions that are most used by salaried individuals: HRA and Housing Loan Interest.

Interest Paid on Home Loan:

An individual is eligible for a maximum deduction of 2 lacs per annum on Interest Paid on Home Loan under Section 24 of the Income Tax Act.

HRA

Your HRA exemptions is least of the following:

- Rent Paid – 10% of (basic salary + DA)

- Actual HRA Received

- 40% of (Basic Salary + DA) for non-metro cities and 50% of (Basic Salary + DA) for metro cities

Example:

Let us say, you are a salaried employee with a gross income of 10 lacs per annum and you live in a non-metro city (cities which are not Mumbai, Kolkata, Delhi & Chennai). You receive a HRA of 15k per month (1.8 lacs pa) while actually paying a rent of 20k per month (2.4 lacs pa). Also, let us assume that you have a basic pay 4 lacs per annum and no dearness allowance.

- Rent Paid – 10% of (basic salary + DA) = 2,40,000 – 10%*(4,00,000) = 2,00,000/-

- Actual HRA Received: 1,80,000/-

- 40% of (Basic Salary + DA) = 40% * 4,00,000 = 1,60,000/-

Since 1.6 lacs is the least of the above, you are eligible for an exemption of 1.6 lacs for the financial year.

Your HRA exemption will reduce if your basic is lower or even if your actual rent paid is lower. However, it can be never higher than the HRA you receive.

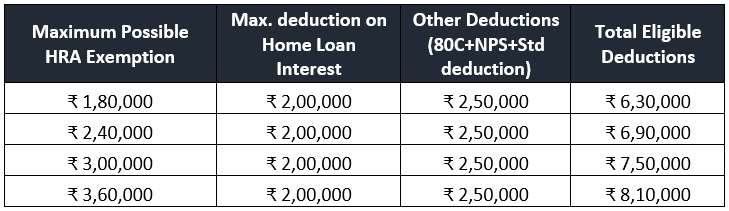

Under the Old Tax regime, taking the above example, we can consider the total eligible deductions as appended below:

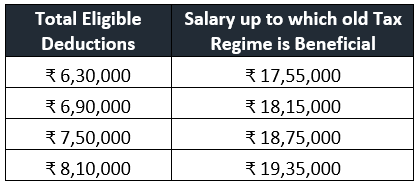

Considering the above deductions, old tax regime is beneficial up to the gross salaries shown below:

If you are eligible for a deduction of 6.3 lacs per annum, for instance, you can benefit from the old tax regime only if your salary is below 17.55 lacs.

However, we are not finished yet.

Let us say you are getting a gross income of 17.50 lacs (slightly lower than the 17.55 lacs mentioned in the above table). With deductions of 6.3 lacs, your tax payable under old regime is lower by just 1,560/- than the new regime.

Now, you’re faced with a decision: should you delve into various tax-saving schemes just to save a paltry 1,500 rupees, or should you opt for a simpler tax regime and channel your energy into wealth multiplication through more lucrative avenues?

In essence, is it worth allocating your efforts on such a marginal tax saving, or would your time and focus be better utilized on strategies that have the potential to significantly increase your wealth?