Debate between investing in gold or equities has been a topic of discussion among seasoned investors for long. We thought of doing a deep dive into the historical performance of these two assets since the beginning of Sensex in 1979. A period of 45 years. It has thrown very interesting perspectives.

Looking Back:

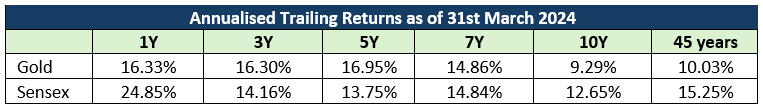

In 45 years, both gold and Sensex have shown impressive performance. Sensex soared 600 times and gold grew by 72 times. In CAGR terms, Sensex 15.25%, and Gold 10.03%. The magic of compounding – 5% difference in return can create so much of difference in cumulative returns.

Changing Trends:

Recent years have seen gold steadily narrowing the gap in terms of returns when compared to Sensex. This trend, evidenced by the annualized trailing returns, indicates that gold is increasingly becoming a competitive investment option relative to equities.

Risk Reward:

Gold has exhibited higher risk-adjusted returns owing to its lower volatility, particularly evident in downside risk scenarios.

Why Gold Matters:

When the stock market takes a nosedive, gold tends to hold its ground better.

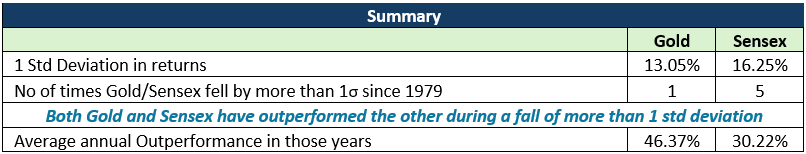

For instance, examining instances where both gold and Sensex fell by more than one standard deviation of their returns highlights how a mixed portfolio can provide alpha on investments.

Explanation: 1 Standard deviation in returns represents a measure of the typical variation or fluctuation of returns from the average return of an investment. When an investment’s returns fall beyond 1 standard deviation, it indicates deviation from the expected or normal performance, potentially signaling significant market movements or volatility.

Since 1979, in 5 out of 45 years, Sensex dropped by more than 1σ or approximately 16.25%. Similarly, Gold dropped 1 time by 1σ or approximately 13.05%.

- During these 5 years of Sensex drop, Gold consistently outpaced Sensex with an average alpha of 46%, a notably substantial figure.

- Similarly, Sensex outperformed Gold by 30% on an average in 1 year drop in gold by over 1σ.

Allocating a higher weightage to gold during periods of uncertainty not only reduces portfolio risk but also serves as an effective alpha-generating strategy, as evidenced by one standard deviation statistics.

Other Trends:

- Since December 2017, the Reserve Bank of India (RBI) has maintained a steady practice of acquiring gold from the market signalling a steady demand for gold in times of uncertainties.

- An Economic Times report reveals that during January and February of the current year, the RBI procured approximately 13.3 tonnes of gold from the market. Remarkably, this acquisition constitutes over 80% of the total gold purchases made by the central bank in 2023 alone.

- China is at the front and centre of the recent Gold rally with its jewellery demand rising by 10% year on year with the People’ Bank of China also on a buying spree for 17 months straight.

As we’ve already emphasized in our previous article, “Gold – The Timeless Security against inflation“, Gold is a great hedge for beating inflation.

Given the timeless demand for Gold in India, we can also say that the asset also emerges as a valuable addition to any investment portfolio, offering not only competitive returns but also a balanced approach to navigate financial uncertainties. By striking a balance between gold and equities, investors can enhance their portfolio’s risk-adjusted returns and capitalize on gold’s potential as an alpha-generating asset.

The versatility of gold exposure through Sovereign Gold Bonds or professionally managed ‘Multi Asset’ funds offered by Mutual Funds can provide investors with viable alternatives to physical gold investments.