Rate hikes are not going to leave us anytime soon. Not that they are going to continue but that their impact continues to affect us all. The impact is especially high on floating interest loans such as home loans. Let us take an example to understand how big/small is the impact.

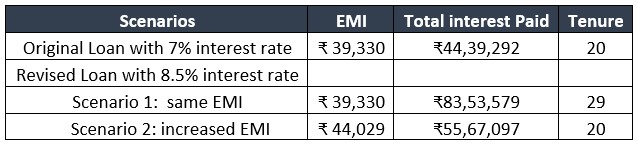

Assume X having an outstanding loan of INR 50 lakh at a 7% per annum interest rate with repayment over the next 20 years. With RBI’s repo rate hikes of up to 2.2% , home loan rates too have increased by 150 bp. With a 150 bp hike, the new interest rate for the loan would become 8.5% per annum

Let us now look at the effect of this increase in interest on Mr. X.

Under scenario 1, the tenure of loan extends to 29 years instead of 20 years.

In Scenario 2, EMI increases by 12% thus impacting the cash flows.

Both options have huge impact either on period of repayment or on immediate cash flows that Mr. X can afford. One can observe that interest paid over the period substantially changes as rates rise.

So how does X get around this additional EMI or extended period of repayment?

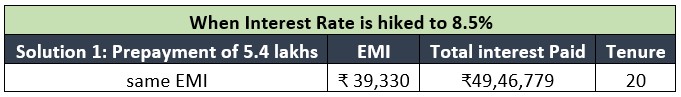

Solution 1:

When the same EMI is continued over 20 years under an increased interest rate, X can drastically reduce the total interest payable by pre-paying a lumpsum of just 5.4 Lacs.

Prepay a certain amount, say 5.4 lakh.

Solution 2: X separately invests the difference in EMIs to negate the effect of EMIs in the last 9 years.

Let us say prepayment is not an option. The original tenure of the loan is 20 years. Tenure increases by 9 years under a rate hike, when same EMI is maintained. The loan outstanding at the end of 20 years would be about 27.27 lakhs. Mr. X has an option to pay increased EMI or invest the difference in EMI (in this case Rs.4699) in an instrument that can yield more than 8.5% return.

Assume, the investment return is 12%. Mr. X needs to invest only Rs.2758 per month instead of paying additional EMI of Rs.4699/-, saving of approximately Rs.2000/- per month. If the investment return is 15%, he needs to invest Rs.1822/- only per month.

The investment proceeds (of about 27.27 lakhs) can be used to repay the remaining loan as a lumpsum at the end of 20 years.

Conclusion:

- It is quite clear that a rate hike, even as small as a 150 bps makes a huge difference in the amount of loan repaid eventually.

- Retaining the same EMI might look good in the short-term but takes a big toll on X’s lifestyle in the long run.

- Prepayment might always be wise as it not only reduces the huge interest burden but also reduces the tenure, thereby freeing up wealth over the longer term.

- While, the above is true, prepayment might not be a possibility for everyone. In such a case, one could explore the option of investments to reduce the burden over the long-term