The infrastructure sector has been the talk of the town these days. While we have a lot of positives going on within the sector, we also must be wary of the fact that the sector is by default highly leveraged. Let us now understand how Infra is positioned in our economy and how to approach it as an investor.

Budget’s Boost to Infra:

Centre allocated about 10 lakh crores in FY24 for infrastructure development, up by 33% from FY23.

This will be 3.3% of GDP (at an all-time high) and is almost 3 times the capex outlay in 2019.

Other Factors contributing to growth:

The infrastructure sector stood at the top with a 47% market share in new project announcements. Also, there has been a 91% increase in award of new projects in Q3 as opposed to the entire H1 of FY23

Correlation:

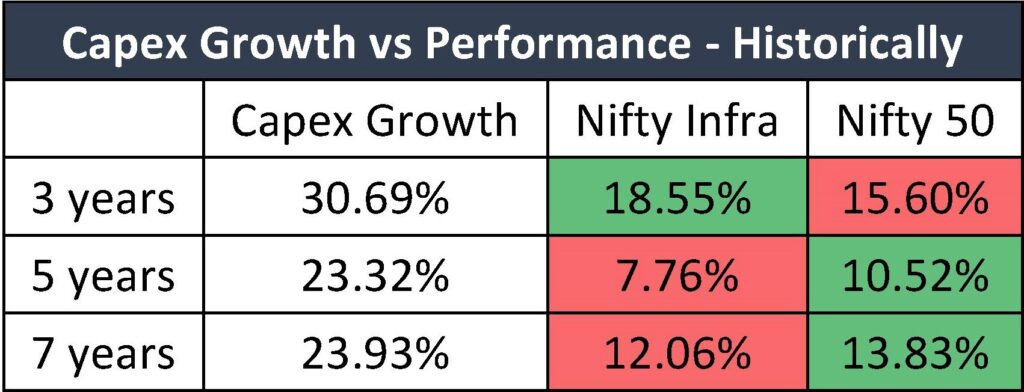

Historically (in the last 14 years), there was not much correlation (a weak -0.10) between the Govt’s capex push and performance of the infra sector as seen below:

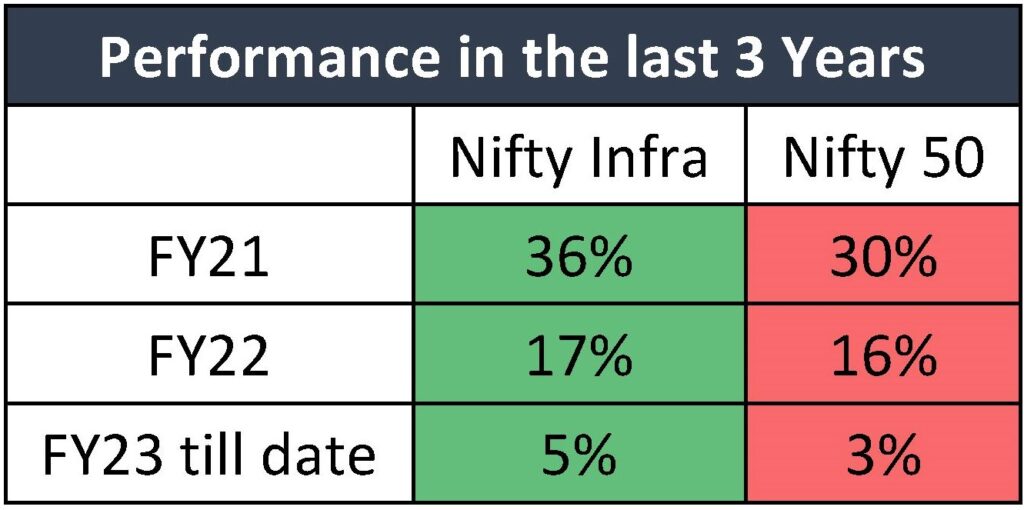

However, the scenario changed in the last 3 years. There was a conscious effort from the sector to de-leverage the balance sheets over the last 2 years. This improved the credit quality of many companies in the sector and subsequent improvement in credit ratings. Upgrades in ratings have led to a revival in optimism for the sector as a whole. This can be seen here:

Nifty Infra has clearly outperformed the broad-based index consistently in the last 3 years. It should also be noted that the capex growth each year in the last 3 years has been nearly 30% and it continues to be above this number for FY24 as well. Given the past performance and the prominence infra has gained recently, it would not be a surprise if Infra outperforms Nifty in the next 3-4 years.

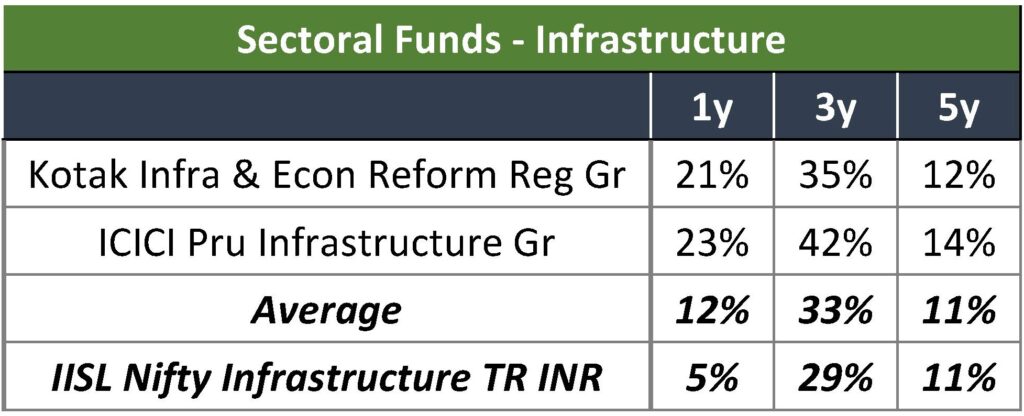

The sector may provide a big opportunity but not all infra companies might be profitable and generate consistent shareholder returns. This, combined with the cyclical nature of the sector makes it difficult to pick individual winners. However, we might try a sectoral fund that might give better risk adjusted returns as seen below.

Exposure to the sector could also be taken through investment in INVITs and REITs, thereby also earning a decent return in the form of periodic distributions.

Conclusions:

- The government’s capex boosts along with a huge order book for the infra sector, make it an attractive investment option now.

- A realistic time frame of at least 4-5 years should be set to gain reasonable returns in the infrastructure space.

- As infrastructure funds are thematic, it is always prudent to limit your exposure to 10%-15% of your total equity portfolio.

- Since individual stock picking is cumbersome, exposure to the sector through a MF route is sensible.