Investment in Real Estate has been in vogue since long, especially for HNIs. The allure of a physical asset has time and again drawn many people to investing in this asset class. In fact, 61% of people prefer real estate as their top investment choice even now, and Millennials are currently driving the housing demand in India.

REITs might be a better alternative to commercial real estate for all the reasons we’ve already heard earlier:

- Easier for small investors as small amounts can be committed systematically.

- Almost negligible liability and responsibility.

- Opportunity to take exposure to multiple properties, thereby providing diversification.

- Higher Liquidity and faster withdrawal.

- Dividend income, in addition to possible capital gains, with minimal risk associated with commercial properties.

However, the best part of Investing in REITs now is that you could invest in these properties at a steep discount.

Let us see how:

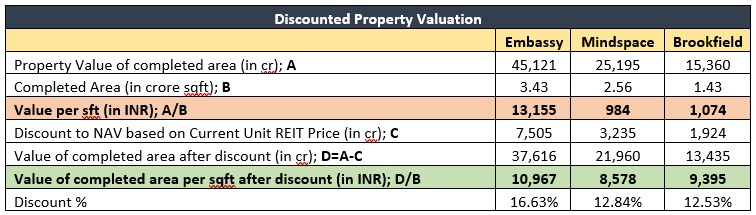

The actual market value of the physical properties is shown in the table below. As can be seen, the unit prices of the three listed REITs in India – Embassy, Mindspace Office Parks and Brookfield India are going at a discount.

For instance, Embassy’s Net Asset Value (NAV) is around 37,982 crores. However, Embassy REIT is currently trading at a price of 321 per share which translates to roughly Rs. 30,000 crores in Market Cap. This implies that the REIT is roughly at a discount of Rs.7500 crores to the REIT’s Net Asset Value.

Now, Property Value of completed area for Embassy is worth 45,120 crores. This is also termed as the Gross Asset Value (GAV) for completed area. NAV is usually determined from GAV. Hence, we could directly subtract the same discount of 7505 crores from Property Value of completed area to arrive at the value an investor would be paying for the same property through REITs.

It means that investors would only have to pay Rs.10,967 per sqft by investing through a REIT, as opposed to the actual value of Rs. 13,155 per sqft – a discount of 16.63%.

The same could be observed in Mindspace and Brookfield where, the REITs are available at a discount of over 12.5% to their actual commercial property values.

Here, we must note that we have considered the Values of Completed Property only and excluded property under construction. Had we considered total NAV, the discount would shoot up to 20% from 16.63%.

These discounted prices, in addition to an average distribution yield of over 6.6% per annum, should make REITs the preferred choice for taking exposure to Commercial Real Estate.