Passive funds have become a hot favourite among investors, witnessing an impressive 36% surge in inflows. The appeal lies in their perceived safety compared to active counterparts, as they simply track the benchmark.

To understand the dynamics between active and passive funds, let us break it down.

- Active funds are strategically managed investment funds, where fund managers make decisions to buy and sell securities to outperform the market or a specific benchmark.

- Investment funds designed to replicate the performance of a specific market index or benchmark by investing in the index constituents with the same weightage as that of the index are called Passive funds.

Now, let’s delve into a comparative analysis to uncover the truth behind these preferences.

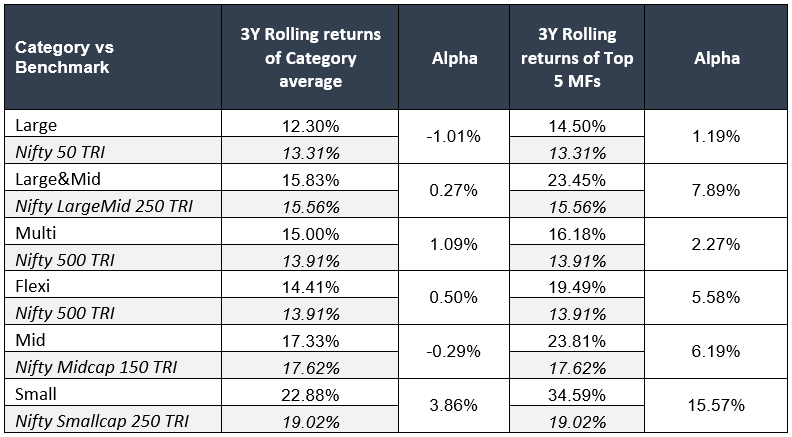

Starting with a focus on active funds, Table 1 illustrates their rolling returns against respective benchmarks. Rolling returns emerge as the superior metric for assessing fund performance, avoiding biases associated with trailing and point-to-point returns.

Table 1:

Analysing the data, it’s evident that, except for Large Cap and Mid Cap funds, Active funds have outperformed their benchmarks on an average.

The performance gap is particularly notable in Small Cap and Multi cap which gave an alpha of 4% and 1% respectively.

Then, we have calculated the average 3Y rolling returns of the Top 5 Active MFs in each category in the last 10 years.

A closer examination of the top-performing active funds in each category reveals a different story.

Take the Large & Mid category, for instance, where the average of the top-performing Mutual Funds beats their benchmark by approximately 7.89% while the category average has outperformed only by 0.27%.

An investor might opt for Passive funds, believing that active funds don’t yield substantial alpha. Yet, by doing so, they would overlook the significant outperformance, approximately 7.5% in this instance.

The alpha is even more remarkable across the Small Cap category (over 15%) when the top 5 active funds are considered.

While Active funds on an average have not created much of an impact when compared to their passive counterparts, the top set of active funds has outperformed its benchmarks by such huge alpha that we simply cannot ignore the Active Funds altogether.

It’s crucial to recognize the impact of alpha on investments; a 1% alpha per annum can multiply your investment nearly 1.63 times in a decade. This potential difference could be a game-changer for the average investor.

To sum up, professional guidance is crucial for successful investing in active funds. While passive options gain popularity, active funds, when managed by experts, showcase the potential for significant outperformance.

Subscribe on LinkedIn