Addendum to InvITs Investing – https://wp.me/p9kGd9-6g

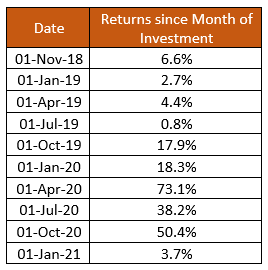

A re-visit to our blog of 2 years ago when IRB InvITs traded at ≈28% discount to its IPO price. Our stance back then, given the heavy discount, was that IRB InvITs looked an attractive proposition for long-term investors who look for periodical returns by way of regular cash flows. In this addendum, we are updating the return profile for investors who purchased units at different points since then.

Observations:

- Against a discount of 28% in Nov 2018, current discount stands at 45%

- Although units currently are trading at higher discount, interim payments amounting Rs.21.2 since Nov 2018 have made up for the price movements

- All Investments for above period have yielded +ve returns

Summary:

- Since Inception, IRB InvITs have collectively paid Rs.37.3 as interim Cash flows (Interest & Capital reduction).

- Since the Units pay perpetual cashflows (current longest maturity stands at 2047-48), it is a +ve NPV product.

- At current levels, assuming an annual payout of Rs.8, the product yields ≈16%. No other AAA-rated product in Indian financial Markets is delivering such returns.

- Another angle is to look at this investment as a collateralized loan to an AAA-rated institution @16% pa. In effect, you get your principal back in 6.5 years and continue enjoying the Cashflows perpetually. (Investors may face market risk if they need to liquidate the product in a short term)

- Investors may consider adding more to their portfolio at current levels to enhance yields.

Please note that the above should not be construed as advice from us. Our company is in the business of distribution of suitable Financial Products to investors describing product specifications, material facts, and the associated risk factors. We are acting as a Distributor for these products and facilitating transactions.